Everybody’s heard about the California gold rush. Cody Cox likens his journey as a note investor to it as he discusses how he pans for gold from distressed mortgage. Cody Cox has over 34 years of mortgage and real estate investing experience. He says the lure of getting away from the rigors of the day job is not all about money. It’s really about the freedom of being able to do what you want on your own schedule rather than on somebody else’s schedule. Cody talks about how he goes about finding his investor’s pot of gold at the end of the distressed mortgage rainbow.

Listen to the podcast here:

One Investors Pot of Gold with Cody Cox

We have Cody Cox, who is a well-known friend, investor, student, and all-around funny guy. He’s here to talk to us about the investor’s approach to finding the pot of gold we’re all looking for. After these things about finding private money and advertising properly and everything like that, Cody will sit back and give you some of those real-life scenarios of how he’s done that.

I’m excited to be here. I want to say thanks a lot for all you who are here. I wanted to say thank you because I know you had a tough choice, either it’s listen to Cody Cox or the Note Queen. I appreciate you making the choice to sit and talk with me and talk through me and listen to what I have to say. This is my first time doing this for Note CAMP all by myself. I’m excited about it all. I have been on a couple panels before and it’s always fun. What I’m going to talk about is my investor’s approach to finding the pot of gold.

As a quick introduction here, my wife is Wanda and I’m Cody. We’ve been married 34 years. She is remarkable. I say I’m the managing member; she’s the one that helps me remember. Josh is my oldest son. Josh is our media manager. What Josh does for us is he sets up my website and he does a lot of the marketing material that we send out. I still write the blogs, I still did this PowerPoint presentation, but he does a lot of behind the scenes stuff for us. What I’m excited about is he’s going to come to mastermind. I can get a better idea and dig in further about what he does and what we’re doing here as a note investor.

What I’m going to do here is I’m talking about the money, the pot of gold, but it’s not about the money. I’ll take the money, but it’s not all about the money. I’ve had two things that had been playing on my mind as I go through this further is it’s about freedom. This was Wanda and I a few years ago on a national Rio cruise and I enjoyed those. Those were great. I need to get back doing some of those things. There are some hurdles to get back to that, but the freedom of being able to do what we want, when we want, as we want on our own schedule rather than somebody else’s schedule.

The second thing has been playing on my mind is what we call legacy. I’m getting ready to step away from working for other folks, and what am I leaving behind? How am I touching other people? One of the big things about my wife Wanda is she likes to touch other people. She’s got some things inside them to share inside of her. Being house-down, being more of that, at least, where we are moving to is going to give her a better opportunity to be able to touch a few more lives. That’s part of that legacy. I remember, when somebody does the tombstone, they have the date they were born and the date that they passed away, but there’s that dash in the middle. That’s the thing that has got me thinking about what would somebody say about myself and my family about that dash. Those are some important things to think about giving back. It’s many wonderful things that have happened to us. It’s time to start thinking about that.

The other thing is I have this little prospect or theme going on here. It’s panning for gold, the prospector. Everybody’s heard about the California gold rush. I live up here in the Pacific Northwest. I live up in Oregon. We have this big old trail that came up to where we’re at. I remember a few years ago I was at a conference in St. Louis and we had an open evening. We went up in the arch like everybody has to do and then I’m down in the museum beneath the ground there. All of a sudden, it dawned on me, I live at the other end of this trail. It’s a neat realization; I remember that distinctly. There’s still some of those old wagon rafts out in Eastern Oregon, that you can go out and see the real history of that. I’m out here, of obscurities. There’s not a whole lot of note investors up here, but we’ve got a growing crew going out here. It’s exciting to see and I know at least one, two folks who are going to be with us, it’d be good to deal with that.

Distressed Mortgage: If you don’t have the systems in place and if you don’t have the discipline to sit down and work those and push through those obstacles, you can get behind.

First of all, who I am. I talked about being out here in the Pacific northwest. I’m a humble mortgage guy who grew up in Eastern Oregon. I’m out there again in obscurity. It was a farming community of about 5,500 that I grew up in. I think it’s about 5,700 now, so it hasn’t grown much in the last almost 40 years. One of the things I think is unique about what I can do is I have been in the mortgage industry for 35 and a half years, so it gives me a unique perspective. I grew up in Eastern Oregon and I grew up in what is called the Pea Capital of the world. The little town I grew up in can more fresh peas than anywhere in the world. We had the pea queen and pea princesses and all that stuff, but we worked. When I was sixteen, seventeen, eighteen years old, we worked. That hard work inbred in me of a work ethic, and I’ve worked hard almost for somebody else since 1974. At least with this note investing type of industry, I can work more for myself and, excuse the pun here, the fruits or vegetables of my labor come right back to me.

I am the managing member of Trinity National Holdings. We’ve been around for about seven or eight years. I had a former name because I used to do some home flipping at one point in time under a previous entity. We simply changed the name over because now I’m 100% focused with my investing side of things with that one claim in that stream with Trinity National Holdings and note investing. My day job, I am the home loan program manager for the Oregon Department of Veterans Affairs. I am a state employee. I work for the Veterans Affairs Office in the state capital, I commute down there every day. Oregon is one of five states in the whole country that has a dedicated home loan program for the states veterans that is totally separate and distinct from the federal VA program. We’ve got our own little niche. I’m the Senior Executive that runs that whole thing. We funded over $75 million worth of loans to Oregon veterans. I manage a portfolio of $310 million loans. It’s got about 2,000 loans in it, and I’ve got ten employees that do all that.

It’s a hefty day job. I do quarterly reports and have to present to the veteran’s advisory committee on a quarterly basis and part of the executive team. I’ve spent the last weeks with my head down rewriting laws. It’s been fun. I’ve been rewriting some statutes and clarifying the language. It’s a neat thing. This kid from Eastern Oregon who grew up in a simple lifestyle in obscurity is now writing laws for our state and rewriting laws. It’s a neat thing to see where I’ve come and it’s by prayers, my wife, and the grace of God that I got there.

One of the unique things is I also worked on the Oregon Hardest Hit Funds team. I was in the mortgage business for 35 years, I was an Account Executive for about seven years, and then in 2009 I got fired, because the whole mortgage industry collapsed. Nobody was wanting to write loans through broker, so I was gone. I was unemployed for sixteen months, flipped a couple houses, wholesaled some, and then I got a job again on the Hardest Hit Funds team. I understand that program and the appeal to it and I was interactive with that. I was a mortgage loan servicer. They called me contact service liaison and I had 225 different mortgage servicers and that is a single point of contact.

The other thing is I was a Former President of Northwest Real Estate Investors Association here in Portland. They are the largest real estate investor association in the northwest outside of the Puget Sound. I grew it up to about 300 members. What is fairly unique here is that I run a company. I have two other companies that are in my IRA’s because they have checkbook IRA’s and are investing in notes. I’m running into major mortgage company as part of the Hardest Hit Funds team, and I understand real estate investing as being a former president, board of directors of a large real estate investing association.

One thing about that is when you are president of the REIA, I took on the capacity of bringing in speakers to the group. I got called on a lot of things. I got to go to a lot of three-day seminars and travel a little bit and got caught on going on those. Then I found Scott Carson. He’s the only one of the trainers out there for everything that I’ve spent money on, and that’s because I’ve been able to analyze and know what I want and see what I want. We’re all business owners. We should have our model set. Scott provided something that appealed to me. When you got 35 years in the mortgage industry, you have to go, “What am I doing? Why am I trying to flip houses? Why not take that experience and leverage into something else?” I wanted to make sure I made that point because Scott and you have been instrumental in where we’re going. I have been a note investor since 2015. My first note is going to be one of the case studies we’ve got coming up here. I have notes in Ohio, Indiana, Illinois, Michigan, and Missouri.

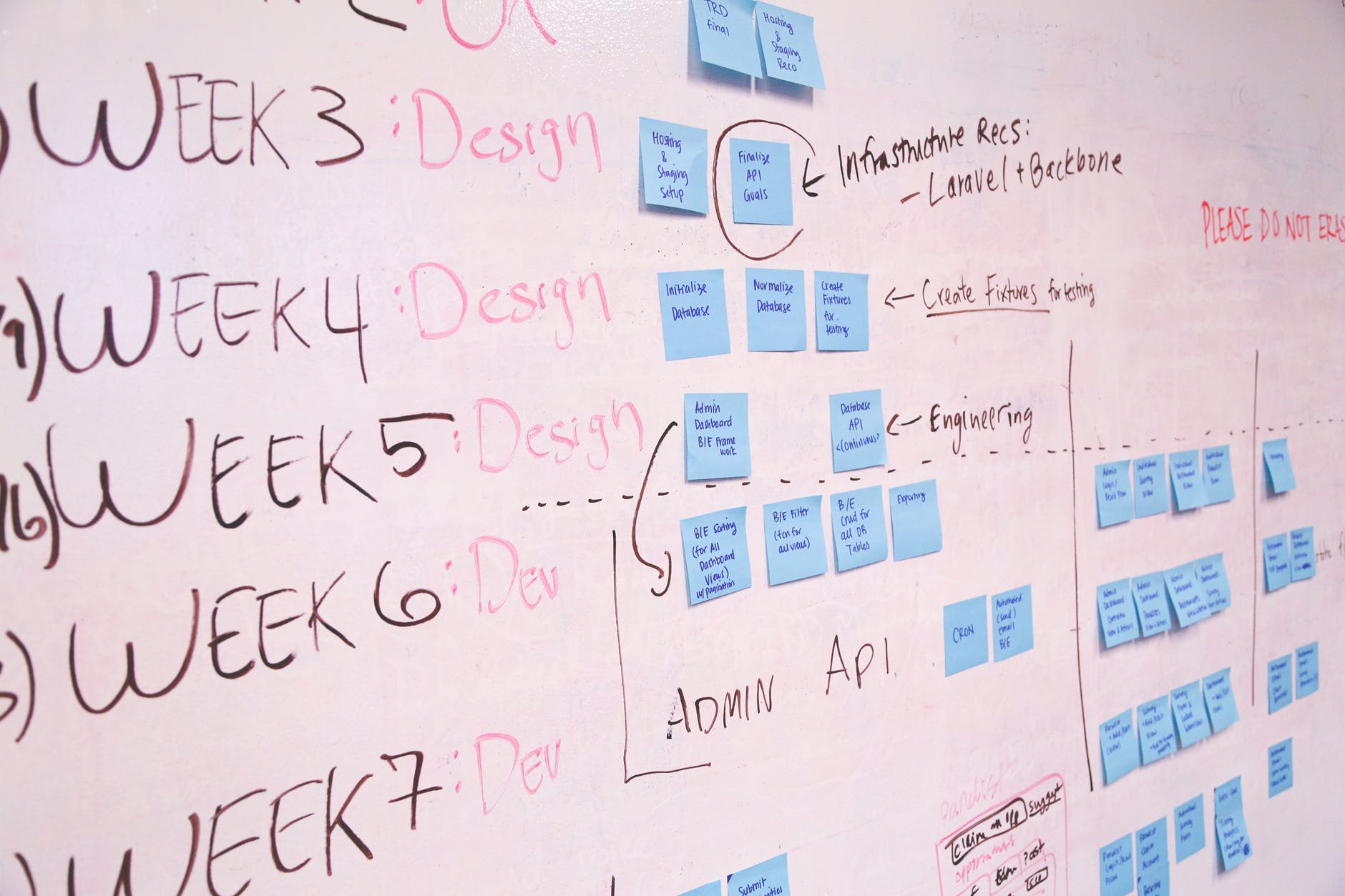

I’ve got claims in two streams. I have a day job. I work 40 hours a week at the day job. I talked about this. I manage ten employees. They’re union employees, which is interesting. I dealt with a high-level HR issue, which I don’t have to deal with that with my team much. Usually it’s one of the other staff on another department. It’s state government. I’ve been rewriting and effecting some laws, which are some of the statutes. Rules are a big deal. Rules are the things that we can write internally to make the statutes applicable, that the public doesn’t have a lot of say over. Here’s my typical schedule. I get up at 5:30 in the morning almost every morning. I used to say that God intended to see the sunrise, he would have made it later in the day, but that’s the thing because I have to catch a bus. The bus leaves at 7:10 AM, whether I’m standing in line or not. I’m on somebody else’s schedule a with the bus. It doesn’t a run during the course of the day, so I can’t catch the bus until about 4:15 PM. I get home by about 5:30 PM. Hopefully, I get a chance to eat, and then try and do my note work here between the 7:00 PM and 9:00 PM each night, and whatever I can do on the weekends is the big deal.

The reason I go through all this is it’s important to understand because I know there’s a lot of folks out there that are probably listening that have a day job as well. It can be done; I don’t do every night because there’s this gal sitting in the other room that likes to talk to me from time to time, so it takes a discipline. I get home 5:30 PM, get off the bus, and I’m going, “I’m tired. I don’t want to do this,” but you’ve got to do it. You’ve got to push through. Right now, I’ve got almost 30 notes in various stages of the process. I’ve got rebid in that I submitted. I’ve got a few more than I’m going to work on yet. I’ve got some that we’re trying to do loss mitigation on, and I’ve got some the run in the back inside that we have done a deal or two of those. We’ve got some foreclosures for trying to liquidate.

I’ve heard this magic twenty notes number and everything changes, and it’s true. If you don’t have the systems in place and if you don’t have the discipline to sit down and work those and push through those obstacles, you can get behind. That’s the important thing. I would say the whole key in this is these three things. One is discipline. There are systems and automate as much as you can. I encourage you, if you hadn’t seen Adam Adams’ stuff in the videos that he has on YouTube, you got to go look at those because I follow a lot of what he does, which helps me out.

I talk to many people that come in and say, “I want to do notes. I want to do real estate. I want to escape my job, but I work full time.” They ask, “Can you actually manage this part time?” I usually tell them, “You can, you have to be consistent and diligent about it and it depends on how many hours a week you can dedicate to it.” With your schedule, you’ve got ten hours on the weekdays over the course of the five-day week, and then you’ve got whatever you put in on the weekends.

Distressed Mortgage: Success is nothing more than a few simple disciplines practiced every day.

He also travels a little bit, but he’s needed a clone for about three years that I’ve known him. You hear a lot of the other big influencers talking about managing your time, and they point to the other magic number, the 7:00 AM to 2:00 . From 7:00PM to 9:00 PM, you’re getting this done. After the kids go to bed, it can be done. Putting that out there, that is a long day. 5:30 AM to least 10:00 PM is a long day, but you’re getting this done, so I’m proud of you and thank you for putting that out there for everybody.

I talk about having the claims in two streams, but I also know, and I finished this book, I’m just three feet from gold. One of my favorite mentors that I met once is a guy named Jim Rohn. A lot of guys post stuff from Jim Rohn, but he has a saying that success is nothing more than a few simple disciplines practiced every day. If you put in that discipline, you put it in the systems, and you put in that automation, those are the simple disciplines that you do. It was interesting to see Adam Adams. He had up there his schedule, what he does, and it talks about the automation he put in. I’ve taken his lead. I’ve tried to pull from him as best I can.

It goes back to what I said in one of the previous slides, is you got to remember your why. I liked the statement that says, “Your why has to pull you. It’s not a matter of pushing you, but it’s got to pull you.” You’ve got to be open to being pulled by something that drives you so much. One of the things I didn’t put in my time schedule is from 2:00 AM to 2:45 AM because that does happen. Fortunately, I have Pipedrive. I use Pipedrive. I have my phone there because it serves as my everything, my alarm. I could punch in something quickly on the activities to remind me the next day to do that. I sleep well most of the time, but there’s this magic. It’s actually 2:12 AM, and it’s about 2:47 AM. I’m up that night, almost every night.

Every one of us have to have their little elevator speech, because it all begins with marketing. When you think about it, the moment that we’re born, we’re marketing. “Where’s mom? I need some milk. I’m hungry.” We would do that immediately when we are born and whether we realize it or not, we’re doing that throughout our whole life. What we need to do is be focused on the things we do. I come up with my elevator speech. We get this question all the time whether we’re networking or talking to somebody you knew and asked you this question, “What do you do?” Most of us always default to our job, and I’m trying to say it depends on who my audience is.

That’s an important part of all our marketing, but typically I say something like this:“I help people just like you attain higher returns with their investment capital IRA’s by investing in non-performing promissory notes secured by residential real estate.” You say that several times and you finally get the feel for what you want to say. That’s the answer where somebody is going to say, “What does that mean?” I need to simplify. “I’m the bank. I buy mortgages. I own mortgages. I’m the bank. I’m not the landlord. I don’t want to be a landlord. I want to be the bank.” If your toilet breaks in the middle of the night, you’re not going to call Wells Fargo.

Everything starts with marketing, and you’ve got to have a plan in your marketing. I know that one of the speakers yesterday talks about before you rip something out, you step out of the shower, you have some cool thought hit your head, you just can’t rip that out. You’ve got to have a plan. My little comment down at the bottom there is a prospect would never just go dip their toe in the water anywhere. You’ve got to have a plan on where you’re prospecting at. One of the things I always said when I was the REIA President and I introduced a new speaker, it was, “This guy is going to bring some things that are cool.” We’re all business owners. If this is part of your model, pay attention and then think about buying the program. If it’s not part of your model, pull a nugget or two out of it, but it wouldn’t be worth your time to owe money to buy it. We all have this model. We’ve got to follow our model. I know that the times that I get hurt the most or have been hurt the most is when I’ve stepped outside that model.

You do that a few times until you figure out what your model is.

When you lose $10,000 in your IRA on two different transactions, you’re going, “I’m not going to invest in unsecured personal property manufactured homes again. I’m going to look at that O&E report and review it more carefully before I loan their funds. Over the life of my mortgage industry, I bet I’ve been involved in over 10,000 different transactions in various capacities. What my basic model is as I’m looking and I’m panning for owner-occupied notes, one to four family residential. I don’t do anything on a commercial basis. I don’t like vacants, I don’t like REOs, I look at the value range between $50,000 and a hundred $150,000 in as-is value as it sits today.

I’m looking at institutionally-originated loans for acquisition. It might be different on the liquidation side of things, but for acquisition, these are the ones I’m looking at because those are the ones I know. Those were the ones that I’ve done for last 35 and a half years. I liked what Scott talks about, is making sure that the recoverable value exceeds the value of the home. That enables me to purchase it at a more aggressive discount and gives me a lot more room to work with that owner occupant and trying to get them re-performing. My intent on every single acquisition is to find a way for that homeowner to retain the house. I’ve spent about the last 35 years putting people into homes, and I’m going to end my career attempting to keep people in their homes. I like that. Let’s get them in. It was a good loan when we made it, servicing screwed it up.

Then by being upside down without you or have the ability to purchase at a deep discount. A basic model here. I work the file to re-perform. Sometimes I do it myself. I understand being in the mortgage business what I can say and what I can’t say with also the intent to resell it, substantial gain. I do work with Daniel Singer through some loss mitigation stuff. I’m trying to move everything to one servicer. I have another servicer that requires that I use their attorney, which so far, I’ve not been really happy with. I worked through Daniel, Scott has some attorneys to refer to. I’ve been pleased with those so far.

A little bit about my marketing, I talked about being pulled to your why, having your why call you. Marketing in the note industry is a little different than what you do in the fix and flip or the landlord or the wholesale. All of that is outbound marketing. I belong to some wholesale groups on Facebook and you see, “I’ve sent 10,000 yellow letters today,” and I’m going, “Times 55 sets and maybe they get a discount,” but that’s a lot of work. I don’t like that. If I’ve got a day job, I’ve got to be sensitive to the fact that I can’t send out 10,000 letters because if just 2% of those call, I can’t handle the calls. I got a day job.

In my marketing, I like the aspect of outbound marketing. I’m panning for the gold. Each time I send out any marketing piece, whether it’s my weekly emails or I do my Friday strolls or whatever that is, I have to ask this question, and I this is a really important question. Who am I marketing to? Who’s my end person that I’m trying to have look at this particular marketing piece that’s going out? I see too many people, I get too many emails or whatever, where the marketing piece that comes to me is not something that I’m going to respond to. I’m not the person they should be marketing to. The worst thing is if somebody is going to shoot me an email where I’m looking at their Excel spreadsheet, is that something they’re also sending out to somebody else?

Distressed Mortgage: Your why has to pull you. It’s not a matter of pushing you, but it’s got to pull you.

We have to have a higher level of thinking with regards to what we send out as far as marketing. Every time I send out a marketing piece, I’m looking to two basic targets. One is I’m always prospecting for a joint venture investor. I always call them investors. I see sometimes people call them partners. They’re not a partner, they’re an investor. A partner implies that you have an ongoing relationship to them. It could mean that you have to file a certain type of tax return with them going on. To me, they are investors, and that’s the way I always approach them and always call them. The other target is I’m always prospecting for somebody to sell a note, either a hedge fund to bank, maybe somebody else is listening to us right now who has a small pool. Those are my two basic targets. Those are the folks that I’m trying to find money and trying to find something to buy.

I have two basic premises every time that I won’t do. I will not send out an email to somebody I have not vetted asking for money. Even though I may have been awarded a note to purchase, my emails go to a group that I’ve already vetted that I know have committed to me that they’re going to fund my deal to meet certain parameters that they look at. If I have 3,500 people on my regular email account, they’re never going to get asked to fund a specific deal for me. They’re going to get asked to get involved with me, but they’re not going to get asked to fund a certain transaction with me.

The big thing I have found, and Scott told me about and commented about before and I’ve heard it a couple of times when we listen to some of the people who do marketing for their day job, is you got to be consistent at it. You’re not going to get any return by sending something out once a month unless that’s what you want. Maybe you’ve already got the pool of money, you already got your internal investors, but for me, I have to think about it like pull dates on milk. You have the guys in the diary and when the milk expires they got to get rid of that and pull the new ones forward.

Investors have other things going on. It’s a fallacy to think that they’re holding their money, waiting for you to come up with the deal for them. That isn’t going to happen, but you’ve got to keep in front of those folks on a consistent basis to let them know that you’ve got something going on. I found that the consistency is really important because as I heard it again, sometimes it takes five times and now that number is seven times that people get touched before they’ll respond to you. Even then you respond back to them and they go dark on you.

When do you get the time to call banks and find sellers?

I have a day job, but I get a break. I get a lunch hour and I get a break in the afternoon and sometimes I have to wait for the bus. You have to plan those things, especially a lot of the things I deal with are attorneys in the Midwest. They’re on a different clock. They seem to forget that I’m on a different clock too, so when I get the Facebook Messenger Ping at 5:15 AM because they’re already at work, you got to take that with a grain of salt. I don’t do a lot of bank calling. Mostly, it’s email marketing. When they email back to me, then I secure the time that I could give them a call back and have that conversation.

It’s a matter of taking advantage of those little times and pre-planning, looking ahead and pre-planning. When can I call back this bank at Hamilton Bank in New Jersey that are three hours ahead of me to make sure that they’re still in the office and I can make that call. I’ve gotten up really early in the morning to call attorneys and have a little conference on them when we’re trying to set an opening bid amount and things like that. You have to take that time if you’re serious about it. If the draw of the why is strong enough, you’ll make time for it.

In a mailing list, how do I build the list? That’s a big thing. I build a list from a number of different ways. I took every one of my email addresses, which is AOL, Yahoo, Gmail, and iCloud, and I’ve downloaded every time I have had some email conversation. I’ve had an AOL account since early 1980’s. In fact, it’s a funny story. When I was a loan officer, I’m in the heart of where Intel is, and I actually somehow got into the team that built the Intel Pentium chip, if you remember the old Pentium chip. Those guys got some significant bonuses and they all decided that they wanted to build a house. Fortunately, the first guy was the team leader of that particular group and he came to me and I put a construction loan together for him and built this new house and he sent everybody else on his team to me.

The folks working with me, they’re out of that same team. I remember the first guy handed me one of his business cards and this is in the late ‘80s, early ‘90s. It had his name at Intel.com and I’m going, “What is that?” That was fascinating to me and I remember having a twenty-minute conversation with him about email and how it worked and what it is. I worked for savings and loan, we didn’t have anything that sophisticated at that point in time. I went and got an AOL email and I’ve downloaded everybody on that and they’re all part of my mailing list right now. I also pulled lists from previous of connections at Northwest REIA. Again, we know how to pull things out of our LinkedIn. I have a note camp list, which there’s going to be a few additions to that coming up. I’ve been asked to do a few speaking events and with that, and I grab as many business cards as I can, because those can be listed to me. You got to be interested, you got to get them on the list.

IRA investors, which there are opportunities to purchase lists that have those IRA investors. If they’re self-directed IRA investors that are looking for other real estate opportunities, they’re more open than somebody else. Like I said, I financed a lot of houses through the years, so I look at loan officers and realtors to put on my list. Here’s a real neat deal. I put my vendors on that list because I’ve had two or three or four different vendors for potential investors over to me. I think that’s a really good thing.

I have two IRA’s. One of my IRA is from a group here in town. That was the first one that I ever opened. They’re not the custodian. They’re the guys that coordinate to make sure your renewed at the secretary of State’s office and all that stuff, but they refer folks over to me. These guys do 1031 exchanges. It’s a big company here. It’s neat that they’re on my list and they know what I’m doing. Sometimes you get to include your relatives. I’ve heard that a couple times. Make sure it’s the relatives that have money. Anytime you get an opportunity to speak to folks no matter what your sophistication level is, your experience, do it. The main thing that I would always say is you’ve got to be credible. The credibility is the important thing for me.

Also, having the right tools. You’ve got to have the tools to automate and make everything so much simpler than it could be if you’re trying to do everything yourself. I do use MailChimp. It’s important. If this is going to be something that is going to be a business for you rather than some side hobby or side hustle you’ve got going, if this is going to be a really big deal for you and your business, you’ve got to have your website. You’ve got to have a real website. I’ve seen some other ones, and I don’t mean to be critical because we’re all at various stages in what we’re doing here, but the website in the day is good for a little while, but you’ve got to upgrade. Some of the other ones that are a point click, you’ve got to get to a real one.

Distressed Mortgage: My intent on every single acquisition is to find a way for that homeowner to retain the house.

Then you’ve got to ask yourself, “Who are you targeting with your website?” Because I’m not targeting the consumer with my website. I’m targeting again the two purposes and the two focuses. I’m looking for JV investors and I’m looking for note sellers, so I’ve got to make sure that my website is sensitive to those. It’s also important to have a real email address rather than a Gmail address at this point in time because it adds the credibility. I had a Gmail address for the longest time, I had an iCloud email for the longest time, but I hired my son. My son is my marketing department. He’s put together my website, he’s made sure it got real email addresses. He was instrumental in coming up with all my logos and colors and all that stuff. I’ve hired him, he’s got a little business that he’s doing that does all that, and he’s been beneficial. I get the family rate but I’m waiting for an invoice from him. Josh, if you’re listening to me, send me the invoice.

I have a toll-free number and that’s good. It shows that you’re a real business, having that toll-free number. It costs me a buck and a half a month. It’s not like it’s a big expenditure. Then I use Pipedrive as my CRM. I haven’t got it fully automated yet. I need to sit down during one of those fifteen-minute or half-hour sessions that I have free time and listen to those videos again that Adam has put together. It’s another resource. It’s one of the things I like about Note CAMP. It’s one of the things I like about the mastermind. They provide additional resources and best practices. That’s the big thing in the corporate world, best practices, so make sure that you’re taking advantage of all that stuff. Here’s where I prospect that. I first started my MailChimp. I’ve now got 5,700 subscribers to it. It started off a couple years ago because I had a severe case of the Smonday. Smondays is that feeling you get Sunday afternoon, Sunday evening when you know you have to go to work the next day. That was a perfect time for me to sit down and author these things and get them out to my subscribers.

I do have a Facebook business page as well as my personal page. I post things on LinkedIn, Google Plus, Realty 411, I somehow got hooked up with that and as playing fairly well for me. I never worry about any un-subscribers to any of these kinds of things because the way I look at it; it makes room for somebody who really is interested. Video is the big way to go. I do these Friday scrolls on a Facebook live almost every Friday. Again, I am a fair-weather scroller. I try and get those uploads into my YouTube account and I’m always looking for content to put into whatever I’m doing. You have to think about what your marketing out there. Coming up with content can be a challenge. Sometimes I don’t know what I’m going to write until Monday early afternoon after I wake up from my Sunday nap. It could be something you read during the week, but you got to send it out, consistency, at least weekly, sometimes every two weeks. There’s always holidays.

We send them the ones that unopen. I like that feature within MailChimp, as you can tell who didn’t open them. I resend them on Wednesday morning, so they go out Sunday evenings, the initial one, and who didn’t open them, Wednesday they go out again. I get a lot of folks catching it the second time. Here’s my mailing list, these are the folks I send stuff out to right now. You’ll notice I have the fourth one down there is that when I was a servicer liaison for the Hardest Hit Funds program in Oregon, I’ve gotten all those mailing lists are all those email addresses. Sending stuff out to those guys from time to time proves beneficial as I’m trying to find the right contact within their respective bank that deals with liquidation notes.

Raising capital. This is how I deal with my joint venture investors, and I have to follow the same process every time. That way, you make sure you hit all the points every time to make sure that you say the same things to the investor every single time, and it all begins the same way. It usually starts with a phone call. Either the investor likes something they saw on one of my marketing pieces, they give me a call. We have a long conversation. I like to meet face to face so I am a little bit old fashioned that way. Old school, if you will. I know there used to be a SCC rule that said that you have to have three touches. I don’t think they follow that anymore, but I still do.

Once we meet and we find out we’re going to click, if it’s going make sense between me and a potential investor, I send them new investor package. It’s the same process every time. I send them out my non-disclosure non-compete, I tell them that they’re going to likely see some borrower loan level information, and they need to commit to me that they’re not going to take that and do any stuff with that information. I have them fill out my investor profile questionnaire. Then I send them a draft copy of my joint venture agreement. I want them to see right up front what they’re getting into. I want them to see their responsibilities and my responsibilities. “These are the things I’m going to do. These are the things I expect from you. I encourage them to have their councils look at it, having an attorney look at it, anybody else that’s part of their inner circle that they’re comfortable with. I’ve only had one attorney tear it up, and I got to revise my joint venture agreement based on somebody else’s attorney’s cost. I got to pay for that.

Then they get added to my VIP list. My VIP list is a sub-list of one of those previous lists that you looked at, and they’re the only ones that see when I have an offer. I’ve got an awarded bid on a certain asset or several assets, and I send it out to my VIP list because at that point in time, they’ve told me they’re ready to invest. If they’ve supplied that information back to me, that tells me they’re ready to invest with me and we could move forward. Every time I get a file awarded to me and asset awarded to me, I put everything I’ve gathered into that. I establish a Google File folder right up front. I know Dropbox is big. I like Google File. I upgraded it to 100 terabytes or some big huge stuff that I’ll never use.

That’s the first thing that happen. I upload that into the Google Drive folder and it contains all my preliminary due diligence information. I put my worst-case scenario ROI calculator in there. I know that there’s a lot of conversations about ROI calculators. My personal thought on this is I look through a worst-case scenario. I have to maximize my time and be efficient. If I can come up with what’s it going to be in a worst-case scenario, which is always foreclosure, “What if I have to foreclosure? I have to foreclose on the house and then turn it around?” It’s always foreclosure. If anything happens on that asset, better than that, that’s gravy.

When I send out an email, my VIP email gets a link to that Google File folder so every one of those and gals can gain access to take a look what’s going on. Currently, it’s whoever’s first come gets the first reservation on that particular asset, but I’m revising on a couple of different things to make it a level playing field. Some of the folks that have committed some funds to me have day jobs too, and they’re using their IRA funds from a previous employer and they want to invest with me. They can always get an email at work, so there’s other folks that can gain access to it and say, “I want that asset.” I’m trying to level that playing field a little bit. I’m working on finding a group text notification where everybody can get a text, and then it’s going to say, “Assets available, check your email,” or something short like that. I was particularly interested in that moment thing that happened earlier. I find that fascinating.

I’m also working on using Zoom because you use it quite a bit. I know that when Scott or when Joel Markovitz has some assets that they’re trying to liquidate, they preview it all on Zoom. We can get a free Zoom account, and as long as you don’t have more than a hundred people listening on it, it’s free. Send that out to a link to my investor and say, “We’re going to preview this before I’m accepting any reservations.” Everybody gets to the text notification, everybody can sit on that presentation, and try and replicate the success that I see you having in that fashion.

Distressed Mortgage: Marketing in the note industry is a little different than what you do in the fix and flip or the landlord or the wholesale.

I’ve found that there are a couple of things that we don’t share with each other, even in the spirit of coopetition. One of the things we know share is our JV agreements. The other thing we don’t share is our sellers list, and that’s fine. Those are things that we work hard to try and do, and everybody doesn’t have the same approach to a joint venture. My approach is that they’re investors, they’re not partners. I pitch them on being a passive investor, and I wanted them to remain passive. I’m the active guy, I get paid because I’m doing all the work. One of the questions that came up on The WCN crew had to do with having investors hold title on their assets. I don’t like to have that happen. I have found that that is causes delays on down the road when you have to have that other title holder sign a document or beyond the foreclosure or the warranty deed or anything like that.

I tell them I’m holding title in my company. Your money is not going to co-mingle on any asset with anybody else, but I’m holding title to the property within my corporation. I’ll cover all the costs for having all this, but the investor is secured via this note joint venture agreement. That is their document that puts them in a position that if they need to take some legal action that follows the term of the addendum. I read something by Jillian that says, “You all should have a disclosure up front.” I’m going to build those closure as well that summarizes the details in my joint venture agreement. To me, this is important because I want to be able to maximize my time if I have a joint venture investor that lives in Southern California and I needed him to sign a document, so we can take the next step. I got a deed lieu. Before the county even report the deed lieu document, they wanted a discharge of mortgage. If I had to get a joint venture investor to sign off on that and they weren’t around, that would have added two, three, four different days to me getting that signed off.

I see the goal. They talked about, “How do you evaluate the goal?” A year and a half ago, as I was doing my due diligence, I looked down at my yellow sheet of paper and every one of those were in the same format. I had things on the left side, things on the right side. I said, “Why don’t I build a little sheet that does all that for me?” Then I don’t forget anything. I put together this little due diligence asset worksheet, and once I narrow down the 50 assets on the tape to the ten that I want to look at, then I start filling this thing out. I have the seller’s name, so I can remember who sent me the tape and the title of the tape and when it’s due, and then all the information that they have on their tape, the asset address, the borrower’s name, UPB, all that stuff, and their seller BPO value.

Then I started looking at what my values are, and I capture what Zillow says on its estimate and all these other eleven different ABM’s that are out there, but then I use those ABM’s and drill down a little bit more to come up with my own costs. I added my own comps and come up to make sure that it matches the comp of the subject property. I also have access through what’s called NightOwl, which is a property profile that a local title company has given me access to that I can access properties all over the country. I use the comps on that to come up with twelve, thirteen, fifteen different value estimates and then average them all out from what I think the value is. Then I go through the bid calculation and that’s what I do.

I’m an old underwriter. I underwrote credit, I’ve underwrote appraisals, and this helps move that too. I use the estimate for the comps, I use eleven different ABM’s, I take an average of what they are, I use comps for sales property, which I thought was interesting earlier. I like Realtor.com and Redfin.com, it has good comps in it and then I use my title company providing me access to NightOwl.com. It provides me a property profile with some comparable and also provides me with an ABM. Here’s the fun thing to do. We all use BatchGeo, but when you have these eleven, fifteen, twenty comps, map all those comps in the BatchGeo and see where they are in situation to your subject property because if they’re on the other side of the freeway, are they really in comp? Are they in different neighborhoods? With the use of this particular grid sheet, and then mapping the comps that I come up with this on BatchGeo, they give me a good idea because I was spending too much money on BPO’s and they’re not getting awarded the deal. I had to come up with a way to get a better value up front.

One of the things and other tool I use when you need to leverage is NETROnline.com because they show you some stuff as finding other sellers here. Here is something that I found in Cuyahoga County which is the Cleveland area. We see the bottom three there. They’re all recorded at the same time, but we know that Silver Hills Solutions LLC ended up buying that. Are they maybe a seller for on down the road? Scott showed us a little trick on one of his Monday night things about using NETR Online going directly with the county. Here’s what it can come up with. The other thing is your O&E report that I had. You can see the last three people that bought this note could be potential sellers. You can’t violate your non-disclosure with the people that gave you the note, but you can look these folks up on LinkedIn and send off a connection request for later. This is another little tool that I use to try and find sellers.

Here are some case studies. My first deal was an ugly little house in Klamath Falls, Oregon. It was a first mortgage. I bought it from a hedge fund for $12,500 in my IRA. The original borrower bought it as a second home in January 2006. I don’t know why there is a second home in Klamath Falls. They borrowed $95,000. They were owning for March 2002 when I got it. I accepted a deed lieu from her. It took us five months to find her because she was somewhere in Southern California, but we found her. She signed a deed in lieu. I sold it three days after I recorded the deed lieu, or three days after MLS my net ROI on that. In my IRA was 103% on an ugly little house in Klamath Falls, Oregon.

My second one I’ve got on a joint venture basis. It is a cute little house, the nicest house on the block in Detroit. It’s a first lien. The balance is almost $51,000. It’s valued at $35,000, so there I met my upside down. The original borrower passed away. The niece got it through probate. There was a modification that was negotiated before I bought it. I was okay with that. I paid $19,500 for the asset. They’re sending me a monthly payment of $334. This was funded in part mostly by a joint venture IRA investor, and he’s getting a little under 14% going right back into his IRA. Not a bad deal. Nice little house. I like that house.

This is my home run deal that looked like I was striking out. I have a great investor on this one here. He’s a former hard money investor. He watches his numbers. He’s been a great resource for me. We can grow from our investors as well. I’ve definitely grown from this guy. Here’s a little shack and the owner of this called it a shack in North Las Vegas, Nevada. It was a first mortgage. I only do first mortgage. He had made a payment six, seven, eight years. The UPB was almost $77,000. He owned a whole bunch of money on this one here. When his wife passed away, he never made a payment. It was only valued at $80,000, so we weren’t quite upset. The total pays off, we were upside down because he was only in for seven, eight years. We paid $43,700, and it looked like we were going to have to foreclose.

We couldn’t do for closures in Nevada because the legislature changed some laws to the mediation agreement, so we were on hold for three or four months. At the same time, we started foreclosure. I got an email from my servicer on a short sale offer. We accepted one pay off at $80,000, which was right at the value. It turned out to be a total of an eleven-month hold. I thought it was going to be a lot longer than that. I returned to 28.5% return right to that investor. It was one of my fun times to give him a check that had his initial deposit with me as well as enough on top of that commit 20% or so.

Distressed Mortgage: Begin with the end in mind. Go back and figure out what is your end.

It takes some time. I’ve got five REOs. There’s one that went to sheriff’s sale, but it reverted back to me. I’ve got one that’s a slow pay. Here’s my ultimate goal. This will change if I acquire $3 million of unpaid principle balance on performing loans. I’m using non-performing to get there, and even if the average 9% ROI back to me, that’s going to pay me $270,000 a year that I’m going to split with my joint venture investors. My nugget on this, I find a nugget for $135,000 a year, which will pay me $1,1250 a month, and I could live off that. If you ended up paying as much as 70% for all those, whether they’re non-performing or get re-performing and we buy some slow pace or whatever, I ended up paying $210,000 for that, and my average UPB was $75,000. That’s only 40 notes that I would have to manage in any one particular time.

I would encourage everybody out there to go back and re-engineer your own pot of gold. Start backwards. How much do you mean to live off and maintaining the lifestyle you have now, or improve it by 30%, 40%, 50%? Where do you want to be? Stephen Covey wrote the book The Seven Habits. One of his habits is, “Begin with the end in mind.” I would encourage you to go back and figure out what is your end. What is your draw? What is your ‘why’? Where do you want to be 12, 24, 5 years from now? If you want to do this in a year or two years, what would it take you to raise $2.1 million to make this a reality, especially with all the tools you’re learning in these four days? Then ask yourself, “Would your JV investors be happy with a 9% return?” I don’t think so. If it’s an IRA, 9% is not a bad deal.

You’ve done so well. It’s easy stuff. I didn’t want to interrupt the flow. I’ve enjoyed the flow there. What’s your response rate with banks and sellers? Right now, it may take at least five calls or emails before we hear back from them.

You got to be persistent. The other thing you got to be assured of goes back to that credibility aspect. You’ve got to talk in their language. I’ve got this little unfair advantage because I am one of those guys with what I’m doing for the state. If you can talk to them and understand what they’re saying and be consistent and persistent at it because sometimes it takes seven noes before you get a yes, or they’re going to hit you with something and you’ve got to be prepared for them throwing something not so good at you, but don’t be discouraged. That’s the big thing. Don’t be discouraged. I’ve said this so many times, but it’s important. If your draw to your why is strong enough, your pull, then you’ll pick up the phone and make that next call. Don’t give up on that. Learn from most. Every one of those are learning opportunities. I found an old workbook that I had from Tom Hopkins in 1994. Front row, seat number one for Tom Hopkins. They talk about don’t be discouraged by notes.

You said you had your son create the website for you. Who does the web hosting for it?

I’ve given him access into my MailChimp account, so when I have in there, he’ll go in there about once a month or so and load all of the things at the same time. I’ve delegated that all to him and he does good work. Someday he’ll be able to tell you, or if I could tell you what his background is. He used to work for a company that had associations with Microsoft, Levi’s Jeans. He has traveled to Canada, to England, to Australia, as well as all over the United States. Now he’s doing his own thing, and he brings that high-quality video marketing stuff into what I’m doing here. He’s working on trying to do a little bit more video on my website as well. He brings a wealth of information. He’s definitely his father’s child. He is his mother’s child as well because he’s got some things that she carries that are remarkable.

Where did you get your toll-free number?

I Googled Toll-Free.com or Google toll-free numbers. I can’t remember where it came from, but there’s a lot of mount there. I got a general one. You can pay a little bit more to get one that says 1-800-buy-notes or something like that. It costs you a little bit more on a monthly basis if you want to personalize it, but I didn’t see the real big deal in that.

A big question that we get for a lot of new investors and from a lot of new investors, “Do people at your day job know what you do, and does that interfere with you doing your day to effectively?” I’ve been struggling with this as I’m also brand new.

All my staff knows what I do. In fact, I had to sign that discharge of mortgage. One of my staff is a notary, I brought two others in to be the witness. They understand that, but the thing that I did different, at least I think it’s different, especially when you are a state manager or state government, is I delegated everything to those guys. My management style is hire the right people and get out of their way. They know that they can do what they need to do. I don’t have to be an “administrator” and peek over their shoulder. They get everything they need because I make sure that they get everything they need. There might be a couple of their other executives that know what I’m doing, but I have to be careful about using state resources. That doesn’t mean I haven’t fudged a couple times, but as long as I keep that to a minimum. Everybody nowadays with the advent of the internet has a side hustle. If an employer who has problems with that, they’re going to have problems with other things too.

Have you found that one method is better than another for getting people to subscribe, whether it’s an email type or videos or other?

For me, it’s making sure I get those emails out consistently. Anytime I have an email that comes outside of that, I try and add them into my email. I have a real big guy about getting connections on LinkedIn. I’ll send that one day and do a search. Everybody that comes up on the search, I’ll send a connection request. Then about once a month I’ll go through all those connection requests and add them to my LinkedIn, because LinkedIn theoretically is the more business professional social network. I think that it’s important to use that as an avenue. A lot of people forget about Google Plus, but I also want to give some kudos to Mr. Carson. He shot me an email that say, “Cody, there’s about two to three or four things you need to know in doing website.”

Scott Carson tells me that I look at it, and I encourage you all to do that. I shot that email over to Josh and we looked at that, and Josh fixed a couple things on our website. Then there was one of the speakers, the Serbian Social Gal, who talked a little bit about Google Plus too because Google plus ties right in to Google search. I made a couple little changes on Google Plus, and the results were remarkable because I previously am going and search my website to see how it’s scoring, and it never scored really well. I talked to Josh about SEO and all this stuff. By implementing the suggestion that Scott had, by Josh doing that and me making a little tweak on Google Plus, I can now go in and Google search Trinity National Holdings in this is the number one hit. I did a little thing on Hardest Hit Funds and put it on Google Plus, and so people when they’d go in and target and Google search hardest hit funds, my article was bounced up to number one and number two. If people are trying to find you on Google, take advantage of Google Plus. Make sure you have a presence there.

Distressed Mortgage: My management style is hire the right people and get out of their way. They know that they can do what they need to do.

How do you find people to vet when you’re looking for investors without doing general solicitation? Because you said that you do go through and you’ve got people out before you ask for any money and you don’t do generals.

I send this thing out about 3,500 people every day with some event or some thought or some theme to it. I saw one that I thought was good. It had to do with this baseball playing. That’s a good theme to try and do that because I’ve done some things about base hits versus home runs. You come up with a theme, and you’re going through your thoughts about how that applies the note investing. I talk about experience, examples, case studies, and what I’m doing. I have those two objectives, but they’re on the journey with me whether they become an investor with me or not. These folks are coming through the journey.

Eventually, somebody’s going to get curious enough with that journey that they’re going to call me and say, “I’ve been paying attention to you on these things here for about the last seven or eight weeks. Let’s talk about it.” That’s the consistency. If you go back to Tommy Hopkins, it’s a soft sell. It’s not a hard point blank in your mouth. It’s a soft sell. “This is what I’m doing, this is the successes I’m having, here’s the successes of other folks that are like you.” If you can point out those things, they’re going to get curious enough. I’ve had a lot of people call me and we talk, and they say they’ll get back to me, and I don’t hear back for a while, so you follow up, but again, it’s a matter of building the list, and be consistent in getting something out to that list.

Everyone in the list that I’ve sent out except for one has been my own original work. I sent one about the width of a home plate is seventeen inches. That one played well because that tells people out there this is important to me and the integrity that goes with that story. Then I built some credibility because I have integrity as well. Those are the kinds of things you can do. It’s not rocket science, it’s all sorts of stuff and it is fun to see how creative you can be.

You said you don’t have to keep track of signed files. Have you ever used DocuSign for an electronic signature for your non-disclosures, non-compete, and JV agreements?

I will eventually. I will at one point in time. The only reason is in my way of thinking, I’m still relatively early into this whole game. My big push into this is a little over a year ago, and a lot of these things have a twelve-month cycle. While everything’s going the way I want it to, some things are a little slower. The realization of some profit on the backside is now starting to happen. I’ve got to be sensitive to my expenses to make sure I can find them well, but I know I’ll get to a point, especially as I ramp up a little bit more and get a little bit bigger, that that will be something I will add. I’ve got a contact with the DocuSign folk right now.

Are digital signatures binding, or do they need to be wet?

They’re binding. The Congress has passed a law that allows us to be binding. I know that in my day job, my 2018 whole purpose is to try and go completely paperless, completely digital. If I can do that date and in state government, then I can do that in my note investing here.

Have self-direct IRA custodians been okay with not being on title? I like the idea, but equity trust has told me the investor has to be on title?”

I have two deals with equity on deal, but they’re not on title. They’ve reviewed by joint venture agreement and they sent funds. Maybe that’s an exception. Maybe they like something well enough within my joint venture agreement.

You might want to reach out to Cody and base camp offline and see if you can collaborate on that.

Neil might have to give me a ride home from work. Yeah, in a lot of different ways. He came down to Salem and gave me a ride home from work. It was good for me and hopefully it brought some value to him. Neil is also part of our Portland Note Closers. We meet once a month and we got a little bit of a growing group. I like what we’ve got going there and it’s a good time to collaborate. It’s that best practices. That’s the advantage of things like this and the mastermind and anything you could do on a local meet-up basis.

How long does it take you to get to $10,000 or more a month passive income? I’m going to say it does depend on how many deals you do and what that comes out to is as far as what you need. Like Cody said, like a lot of people say, if you go in and reverse engineer your monthly nut of what you need and then as you start evaluating different assets, your bids, offers, things like that, figuring out what your potential ROI could be on that and also what your worst case scenario it could be on that, you can get to a better idea of how many you have to do to get that.

There was a question I saw on the WCN crew by another local guy, Michael Jones. “Have you ever drawn up a business model?” That’s a good question, because if you don’t have that guidelines, that guidepost, that path to follow, then maybe you’re not going to get to that $10,000 a month, because like Adam says, you got to shoot the squirrel. You got to be focused, you’ve got to have the right draw, and that way you’ll get there quicker. I did Portland, Oregon. I know I could get to Austin, Texas by driving, but it helps if I have a map because I could end up in Omaha and I don’t want to go to Omaha. They have a snowstorm going on.

You got to build that map. You got to say, “This is not a hobby, this is a business.” You’ve got to put it in writing. It is flexible because you’re going to find some more things. I’m interested to see what my business is going to look like twelve months from now it’s an evolution that goes on. As I learn more from you, I learn more from other folks as part of this and the best practices, my business will be different twelve months from now and I look forward to that, so that’s a draw too.

That’s one good plus with the Mastermind group that we have. Everybody sits down at least twice a year and goes through, “What are you doing in your business? What am I doing in my business? What are our goals? What are we trying to get to you?” You had a life hack to get to that one in a way that I feel like it’s faster, but maybe you were more efficient or streamlined with certain systems or cutting down your due diligence time or you learned how to delegate, because how many of us are control freaks and don’t delegate well at all.

I’m getting better at it, but I’ll be the first one to admit, delegation is a weak point. “I’ll do it myself because I’ll get it done faster. I have to stop and teach people,” but everybody and their business models change because they adopt better tactics or new attack. You have to adapt, because if we’re not changing something, the market’s changing something, and every time I turn around, Facebook’s changing something. Even in the realm of marketing alone, it’s back and forth. We just have to adapt? Who’s your dollar a month toll-free company? Did you say that?

It’s something called Callnet or something like that. I don’t look that closely at it. Apple gets 99 cents from me every month. Google file folders, since I’ve got more storage there, they get another buck and a half from me. There are all these things that you can use to add to your business. I would love to go paperless in my note business. I’m too old school on that, I’ve got too many papers, I got to get a bigger file cabinet, but as I think about it, I go, “There’s got to be a way to do that.” If there’s any other questions, I encourage you to take down my email address. I enjoy answering questions. I don’t want to be an educator. I’m never going to do that. There are guys like Scott Carson that’ll do that. I don’t want to try and reinvent the wheel. If you go back to this, that’s what I want to do. I’ll take a phone call and do a best practice conversation all the time, but I’m not your trainer. I’m not your guru.

We don’t like the word ‘guru’. Cody, thank you.

Thank you, everybody. I appreciate it.

Thank you.

Links mentioned:

- Secrets To Winning Government

- Cody Cox

- Trinity National Holdings

- Oregon Department of Veterans Affairs

- Oregon Hardest Hit Funds

- Northwest Real Estate Investors Association

- Adam Adams on YouTube

- Pipedrive

- Intel.com

- MailChimp

- Facebook business page – Trinity National Holdings, LLC

- Cody’s Facebook personal page

- Cody’s LinkedIn

- Cody’s Google Plus

- Cody on Realty 411

- NightOwl

- Realtor.com

- Redfin.com

- NightOwl.com

- BatchGeo

- NETROnline.com

- The Seven Habits

- Toll-Free.com

- Callnet

- WeCloseNotes.com

- Scott Carson Facebook

- Scott Carson Twitter

- Scott Carson LinkedIn

- We Close Notes YouTube

- We Close Notes Vimeo

- Scott Carson Instagram

- We Close Notes Pinterest

About Cody Cox

Cody Cox has over 34 years of mortgage and real estate investing experience.

Cody Cox has over 34 years of mortgage and real estate investing experience.