—

Listen to the podcast here

Self-Storage And Mobile Home Investing with Hunter Thompson

I am excited to have the Managing Principal of Cash Flow Connections, the commercial capital-raising legend, Mr. Hunter Thompson who has raised over $60 million, him raising a third of that personally. Hunter, thanks for joining us on the show.

Thanks again. It’s an honor to be on the program.

Let’s talk about what your focus is. Why don’t you share a little about how you got into where you’re at?

For a lot of people that come to your program when they’re asked that question, they probably talked about 2008. That was a big number. That was a big moment for me, but it wasn’t for exactly the same reason. I was not investing in or focusing on financial assets at the time. When 2008 happened, I was one of those unique people that said, “There’s going to be an opportunity here in financial assets.” I didn’t know enough to know where the opportunity was going to be, but I could tell that based on historical trends and being able to see stocks that were trading below their cash value. I knew there was going to be some opportunity. I went all in to financial assets, first focusing on stocks because that was what was most applicable. It was the most readily available. I spent about a couple of years following guys like Warren Buffet and investing in value stocks. At the time, you couldn’t lose so there were a lot of opportunities there.

Over the years, I started to iron in what I was trying to accomplish financially. It ended up being the same thing it ends up being for most people if you talk to them about their financial goals, which is having enough cashflow to pay off their expenses. That’s common, but it’s very not aligned with most people’s investing strategy, which is investing in blue-chip stocks. I was coming to that realization and simultaneously my major last strong moment during 2010, which is something almost no one talks about, which is the European debt crisis. This was when Europe struggled to something similar to what happened in the United States in 2008 but in the European capital market. Banks froze up. People had challenges even pulling the money out of ATMs in certain circumstances.

I was watching CNBC one day and I saw the pundits were talking about the Greece bond yields. They were talking about if the Greece ten-year bond yields remained below 7%, the S&P 500 was going to be fined. If it went above 7%, the S&P 500 was going to collapse. I was thinking, “After all this work that I’ve put in studying these stocks and looking at balance sheets, how is it the case that something like this is playing a role in my financial wellbeing. Let alone a significant enough role that people are talking about it.” Everyone’s talking about it. Those of you that were paying attention at the time, the Greece bond yields not only do it go above 7%, but it also went above 25% and above 30%. How would I be able to predict that something like that was going to happen? How would I be able to mitigate that challenge? Those two questions are what led me to focus on more straightforward investments, eventually leading me to real estate.

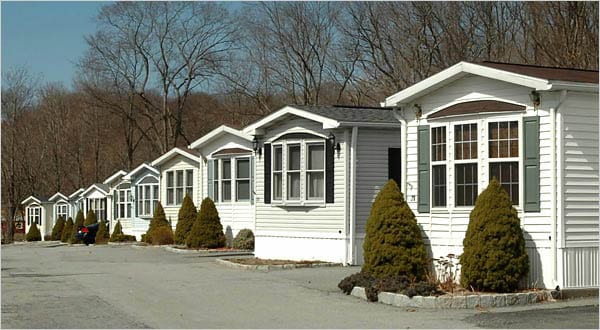

Self-Storage And Mobile Home Investing: The worse the economy does, the more demand there is for affordable housing.

You’ve done some great stuff out there. Why don’t you share with everybody what has been your real estate focus?

The first investments I made in 2010 were doing hard money loans. On a risk-adjusted basis, it was hard to argue with those. There was no liquidity in the market. If you get a 12% or 13% or 15% return at a 60% loan-to-value, 70% loan-to-value especially in a non-volatile market, I would do those investments all day now. The challenge is those opportunities aren’t there in the same capacity because the markets correct it. You can do that at a different leverage point, but not the same leverage point. As that market correction started taking place, I started to get introduced to the world of commercial. If you’re only focused on single-family, something a lot of you will find interesting. You’ve interviewed a lot of successful people in this program. You’ve probably never interviewed one that said, “I started in commercial and it wasn’t for me. Now, I only do residential.”

There are a lot of reasons for that. You do hear people go the other way. Scalability is one. The ability to invest in high-quality assets is another. I found especially in the syndicated model, it spoke to me clearly in the sense that if I’m able to rely on other people’s time, energy and expertise. That is an incredibly valuable situation to be in, especially when you have a complicated asset class where there’s a big difference between a mom and pop owner and a best in class owner. That is what’s compelling about it. I made a lot of single-family investments, but the difference between owning two and owning 2,000 is not that different in terms of your expertise. With commercial real estate, if you have 30 self-storage facilities, you’re a major player in the space. You have systems in place. You have a major advantage over someone that only has two facilities. We use that advantage to our advantage as a passive investor.

We started off in the commercial. We still buy commercial assets. It varies a little bit on how the market has evolved and some of the stuff here. It’s nice to have those nicer quality assets. You don’t deal with the joker brokers or some of the sub-secondary markets. You’ve got more time to do due diligence and break down and go that route out there as well. It’s a smaller niche within the niche of what we focus on. It’s well worth the time to get to know it.

Part of it is a personality test. If you’re more inclined to control every aspect of your investment, the barrier to entry in a single-family isn’t that high. It’s one of the reasons it’s popular. I like to work with people and interact with people that stand to gain or lose millions of dollars. When you’re working with that, you’re working with high-caliber individuals that have a lot of incentives to deliver on the promises. It speaks more of my personality. It’s not for everyone, but I’m willing to give up some of that control for diversification.

That’s a great way to filter through to see if somebody’s serious. If they got $1 million or more of their own money on the line, they’d definitely be a lot more serious about it. Is there a niche inside of that commercial space that you like to focus on?

I’m looking for recession-resistant assets. Historically speaking, all types of real estate are going to do well when the economy’s booming. Every single thing is going to do well. When the capital markets are loose, you can get loans and you can do all this. If you’re looking at trying to balance out your portfolio, I want to identify asset classes that the demand is stable, if not inversely correlated with the overall economy. There are a lot of examples out there. The ones that I find most compelling are mobile home parks and self-storage. Mobile home parks a lot of your audience by now are familiar with that thesis. A few years ago when I was getting started with the business, it wasn’t as common. The worst the economy does, the more demand there is for affordable housing. There are a lot of interesting things about that particular asset class, but that’s the recession-resistant component.

With self-storage, it’s not as obvious but it’s compelling as well from a historical data perspective. People use the product when they’re going through some transitional period. A lot of those transitional periods can be brought on by recessions. You think about kids moving home from college unexpectedly, having a job change, getting laid off or having to downsize. There’s a big Baby Boomer population out there that is relying on Social Security as a source of income. The challenge is Social Security check is literally less than the average two-bedroom apartment in the US. You’re seeing a lot of downsizing, which is creating demand for affordable housing and demand for self-storage. Particularly in markets like Florida, where there’s a large Baby Boomer population. I’m looking at those and I’m saying, “If you’re able to get a little bit of both sides, are you able to get that upside when the capital markets are booming and raise rents more aggressively when the economy’s booming?” When the economy corrects, you’re able to get appropriate financing. Still keep that appropriate financing and get that cashflow. As long as you can weather the storm, you’d be in a good position there.

It’s a great way to weather that storm, recession-proof your portfolio. Still have an asset that a lot of people are looking for and in need of. Affordable housing across the country is getting tighter and tighter and that’s where the opportunities lie the most especially in the commercial space. Self-storage is a great thing because when people downsize, it doesn’t mean they want to get rid of all their stuff yet.

It’s not the case. It’s a consumer economy and people historically do not want to do that. They will put stuff into storage that’s worth $2,000 and they will pay $30,000 over many years keeping that stuff in storage. It’s happened over and over again.

You can set that stuff up on autopilot. You can set it up where it’s automatically billed monthly, ACHs. It’s easier to manage because you’re not dealing with any drama or toilets and tenants and trash outs for the most part, “You don’t pay, you no stay.” We put another lock on it and you’re often behind a gate that we can control.

I’d say that you’re touching on two different things there but they meld together pretty well. First of all, people aren’t supposed to be living there. The laws are favorable when it comes to self-storage in terms of the owners. You can put a lock on their facility quickly within 30 days of nonpayment, four days in certain states and you don’t have to go through a lengthy litigation process. Those things matter when you’re talking about building a portfolio. If you have 30 investments, 40 investments, even if something goes weird 10% of the time, that’s something you’re going to have to deal with on an annual basis that’s not as significant with self-storage.

Self-Storage And Mobile Home Investing: There’s a difference between what people say and what people do, and that’s across the board.

The other thing that you were touching on is that it’s a relatively simplistic asset class structurally. You’re not offering that much in terms of amenities. However, there is a misconception out there that because it’s simple structurally that it’s a simple to manage business. Meaning that everyone’s mom and dad think that they can go and do it. When you do that, you don’t have the systems in place to optimally run the facilities. The truth is, this business operates much more like a business than it does a commercial real estate asset. There are many ways to add value.

A perfect example, one that I tried to give as frequently as possible because people should know about it is leveraging relationships with related businesses. One of those is truck rental companies. We have a relationship with our sponsors with U-Haul. We can buy properties based on their in-place income. As soon as we have the property, call our contact at U-Haul. They park 50 to 40 trucks in our facility and we rent out the trucks with the tenants moving in and out. I have personally invested in properties where that one-line item has gone from $0 a month to $3,800 a month directly to the bottom line. If you’re looking at on the cap rate basis, you’re talking about $700,000 of equity added to the property. This is where the conversation starts to turn a bit, but we’re not focusing on that side. We’re looking at the other coin of that. What we’re looking at is that’s how much protected we are in the event that there is some correction. On a risk-adjusted basis, you’re not doing capital expenditure. You’re not expanding the facility. You’re not going through the risks and uncertainties of development. You’re implementing a strategy and that’s a gold mine as far as I’m concerned.

Is there a size of the two of mobile home parks or self-storage as far as units or size of the asset that you think is a great sweet spot? It’s big enough to be worth the time but not too small to be a pain in the rear where it’s below where you want it to be.

With self-storage, we like to see 400 units or 50,000 square feet. That is when you start to see the advantages of the economies of scale. Our strategy is to have an onsite manager there and that manager is going to cost the same if it’s 20,000 square feet, 50,000 square feet or 100,000 square foot. A typical deal that we may look at is 50,000 square feet with the opportunity to expand by 20,000 square feet or convert some of those standard units to climate-controlled units. With mobile home parks, there’s been a tremendous amount of competition in that asset class that’s happened recently in the last few years I’d say. What we used to say specifically when we want this amount of profile, we’ve had to change that to account for a market correction. I’d say city water and sewer with 100 lots or more is the sweet spot that is appropriate. 100 to 300 lots, I don’t like getting up into those massive properties that are generally located in California and Florida. The cash for cash is not as compelling.

Where do you think the market’s going to go in the next several months? I’m looking at the market. I’m looking at things. There’s going to be a big correction on some things in different areas. Where do you see the market going?

You’ll probably be sympathetic to this. There’s a difference between what people say and what people do and that’s across the board. There are a lot of people that have a lot of respect out there that are constantly pumping fear propaganda, that is not positioning their portfolio in a way that would suggest that they believe that. My viewpoint guided me towards those asset classes. It’s not that we happen to have a business focused on those. I love multifamily and would love to be investing in multifamily, but we had to change our strategy to account for market corrections. Going back to the investment strategy, being nimble in that regard allows us to do that. If we’re only operators, we would not be able to change that strategy, “You’re an expert in multifamily for two years and you’re an expert in self-storage.” That’s why we leverage the partnerships that we have.

To answer your question most directly, when it comes to this stage of the cycle, protecting principal is the most important thing. You’ve probably heard that a lot, but what you have to do that is 100% about debt. I know that’s what your whole business model is based on, taking advantage to some extent or another with people that took inappropriate leverage and couldn’t pay that leverage. We’re looking at 60% sub 70% loan-to-value and I’m talking about as-is value like purchase price value. When we do those strategies like add the U-Haul component, it’s further protecting the equity position. In terms of the next several months, we’re well-protected given the fact that we are at those relatively low leverage points. We have a fund that’s about 58% loan-to-value across the fund. Our goal is not to maximize return but to protect capital and go through the stage in which prices are relatively inflated.

Those that have leveraged out every aspect or every bit of their asset, pulled all the cash out and all the equity out, if the market turns, they’re going to be in the red. You don’t want to be in the red when you’ve got investors involved in that aspect.

I’m intrigued to see what you’re seeing because as those default rates continue to play around these particular, you’re going to be the first person to know. Anyone that’s focused on debt, they’re the ones that go, “Warning, warning.” As soon as the bank says no, that’s when the economy crashes. You’re driving the whole operation.

A lot of friends that are in the apartment space, their goals are to go in, buy the asset with private capital and get the property re-gentrified. Raise rents a little bit and then hopefully get refinanced out in a few years. I’m like, “You’ve got to be careful,” because we looked back at what happened many years ago. Those refinanced options weren’t there unless you were bringing in 20% to 25% to the table, especially with the values dropping. With your assets that you’re taking down, is that a goal in the long run to get cashed out or operate for an extended period of time and keep bringing that cashflow in?

It’s important to be diversified now more than ever. Strategy and risk profile are an important part of that conversation. If we have a balloon payment, we don’t want all of our balloon payments coming due in five years. That would be not advantageous. We don’t want them all coming due in ten years. We want to have enough time to be able to add value and potentially refinance. To me, refinancing is the ultimate goal. We don’t want to set that as an expectation. If we can add value, especially if you’re going through some type of capital expenditure risk, that’s the goal. Three years, that’s cutting a little bit close. I’d like to see a five-year term as a minimum. Even if you are implementing those relatively low-risk strategies in terms of adding value to the property.

It gives the opportunity that if you’re going through something, you’ve got some time to get on the road to get refinanced out and not have everything hit at once. We know that can only be the kiss of death in some cases.

Self-Storage And Mobile Home Investing: If you can have a property that’s a mobile home park, you can see unbelievable multiples which will allow for significant rental increases.

That’s the major problem of every major challenge regarding the loss of principal in real estate. That brings up a good point because we’ve talked about some of the benefits of investing these asset classes. The risks also need to be discussed and the main one that I don’t see being discussed enough is debt. When you’re in these nontraditional asset classes, mobile home parks, and self-storage are perfect examples. The real rift there, especially compared to multifamily, is that those lenders are not going to be able to solve those problems. The great news is if you’re investing in Austin, Texas multifamily. I’ve been scared about the prices in Austin, Texas for quite some time. At the end of the day, if you have a loan due, someone’s going to be there to make that loan. If you have a 100-unit multifamily property that’s in Austin, someone’s going to be there. If you’re in a tertiary market in self-storage, there are a couple of lenders that we work with, the asset class has not fully matured yet. It’s not as competitive, which is why the opportunity is there. When things go sideways, you need a network to be able to solve those problems, which is why taking conservative debt is so critical as opposed on maximizing return.

What are some of the ways that you find deals? Are you reaching out to self-storage owner associations? Do you reach out to local brokers in the markets that you like or the secondary markets that you like? What’s your strategy?

The way that we’re positioned as a company is to leverage partnerships with top-tier sponsors, institutional quality sponsors that have a minimum of $100 million under management. Our actual deal flow comes through those relationships. Me personally, I don’t reach out to brokers. I allow the sponsors to interact with them and they leverage their infrastructure. I do have deals that are sent to me from time to time because of how we’re positioned and people know that’s our focus. I will review the deal, look if it’s in the region of what we may be interested in and then discuss it with our sponsors. For anyone that’s out there passive investing, it allows you not only to leverage those systems and those relationships but also the liability. You don’t have to be involved in the operational side of things to get the benefits of some of these asset classes.

A lot of people want to get in there and touch it and feel it and control everything. The less that you touch, feel and control, the happier you are as well.

It depends on your personality. That’s why debt is attractive. When you invest in debt, you’re able to have the best of both worlds. You can control the asset without owning the asset. It limits your liability in that capacity.

One of the great things that we’ve done with some self-storage units, we’ve done some mobile parks in the past, is when we are reaching out to the banks that are financing those asset classes and they got something that’s nonperforming. It becomes an easy conversation sometimes when we’re discussing buying that debt and bringing in our owner-operators, bringing our teams to manage that, the banks are often willing and able to finance that for you. They let you take over that loan subject too or assume that mortgage provided you can get the dealer, operator or the borrower out of the picture. That’s not the case with residential loans. That’s not the case a lot of times with other asset classes, but it is in the self-storage and the mobile home parks and some of those bigger number loans, $1 million plus, $3 million, $5 million plus. The banks would still like to keep the loan on their books. They just want to move it from a nonperforming side to the performing side.

That $1 million, $5 million, $10 million loan, it represents a problem for them. They don’t want that problem. They don’t have the operational prowess and efficiency to manage that property appropriately. They’re looking for a friend in that instance. You’ve got a friend instead of an enemy.

Are there specific states that you like because of everything going on in them for the most part?

I would say the majority opportunity with the mobile home park business is in the Midwest. There’s a combination of the laws and the combination of the economics of particular markets. There are a lot of economies there where the affordability is quite low. If you can have a property that’s a mobile home park, you can see unbelievable multiples which will allow for significant rental increases. Austin, Texas is a great example of this. The mobile home park business in Austin, Texas, you may have a lot that is 45 minutes or 30 minutes away from Austin, Texas that rents for $550 a lot per month. A surrounding two-bedroom apartment may be $2,100 per month. You’re looking at that thinking if these people want to live in this area if they have a job that’s close enough to this area where it’s compelling for them to stay, you can raise rents quite aggressively before you start to get pushed back from the competitive set. Assuming the competitive set’s a two-bedroom apartment and that’s frequently the case.

When it comes to self-storage, I like Florida in particular as a state for a couple of reasons. There are great markets there with high median household incomes. The state is physically surrounded by water. There are higher income properties first of all, but also you have people that have water toys that need to store those toys. You can balance that out. People talk about hurricanes. It’s an important risk of the asset class, but the simplicity of the structure allows you to recover quickly and you don’t see typically much damage when it comes to hurricanes. Hurricanes are categorically a challenge. People want to stay away from those so we don’t invest in flood zones. When it comes to hurricanes specifically with self-storage, next time you see a big storm, you’ll notice that the occupancy rates of self-storage are through the roof. We don’t wish that on anyone, but I’m saying it’s well-protected the downside.

It’s relatively easy to build units on a self-storage facility. One of the first jobs I had out of college was working for Palm Harbor Homes. The modular homes are not the little cheap things that the big bad wolf could come blow down like they used to be. You’ve got some nice built modular homes that withstand storms. It’s not like Hurricane Andrew years ago where there was a famous picture of this mobile home park that was wiped out and one home was left in the middle. It was a Palm Harbor Home. These days it’s different. They’re easier to build, the ability to build faster. You can build on lots if you’re not renting them out.

Easy to build self-storage facilities need to be considered when it comes to the risk of the asset class. You’ll notice that you never hear self-storage investors talk about replacement cost. The reason for that is not advantageous. With multifamily, you may find that there’s a 50% differential if you’re buying a property. You’re basically making the argument, “It’s expensive to build this comparatively that we can raise rents. We don’t have to worry about development coming right next door.” It’s not the case with self-storage. You can frequently build properties cheaper than you can buy them. What you have to do is be cautious about the supply-demand equilibrium within the five-mile radius that you’re buying in. Typically, people will not drive farther than that. You can estimate that. There are about 7.7 square feet of self-storage in the United States per person. If you’re looking at a five-mile radius and there are only three-square feet per person, you’re in a good market in terms of it could be the case that it’s extremely undersupplied. That’s a rule of thumb. It’s not end-all-be-all, but it’s a good starting point. You can also find markets where it’s illegal to build new self-storage facilities. Then you’re starting to paint the picture that replacement cost isn’t the most important determiner because you can build these things inexpensively.

Self-Storage And Mobile Home Investing: The podcast community has completely revolutionized the education space when it comes to real estate.

You have rates and numbers, expense ratios on self-storage facilities substantially less. Somewhere in the 25%, 28% range.

It depends on how conservative you are being and if you’re including the management fees or whatever. You will find them in conservatively underwritten deals, 40% at a 50,000 square-foot property. 40% would be reasonable, including the management fee. Not including the management fee, it would be in that low 30% range. Let’s say that multifamily, the standard is 50%, that’s a pretty significant difference. I would think that those two numbers are similarly comparative in the sense that a lot of multifamily properties are below 50%.

Tell us about Cash Flow Connections.

The podcast community has completely revolutionized the education space when it comes to real estate. I had to go through a networking event after networking event to get the amount of content that if you just listened to ten episodes of your show, you’re going to understand very quickly. It is not a sales pitch. It is sophisticated people talking about stuff. The challenge is when things go sideways, you have to have friends to handle those problems. You’re not getting friends by just listening to podcasts. We’re trying to facilitate those friendships, those relationships. When you say, “What investor do I know that can solve that problem?” That’s going to come back to not knowing that you have a problem or what the problem is, but being able to email someone and say, “We need 30 days and we need $1 million or we’re going to have a big problem.” There are people out there that will solve all those problems. It’s good to build up that base because when things do correct, everyone’s going to need that friend. It’s going to be first on their list.

Talk about your podcast. I’ve listened to many episodes. I’ve subscribed to it. One of the things is when I have guests on and they got a podcast, I like to go listen. I was like, “I definitely got to have Hunter on the show.”

I have always learned through podcasting and audios. I listen to audiobooks. I don’t like to read physically. It’s efficient but also that’s the way that my brain works. I had built up a pretty significant network of pretty influential people and I said, “Why don’t we record the conversations I’m having with them and put them on the internet?” That idea ended up being much more fruitful than I could possibly imagine. The conversations alone have been a net positive, in the sense that if you had just told me, “You haven’t been uploading any of your episodes. None of them have seen the light of day. You have zero listeners.” It would still be an incredible benefit for me because being able to reach out to these people.

I’ve talked to Grant Cardone. I’ve talked to Doug Casey. I’ve talked to a lot of high-profile individuals. I got off a call with someone that was a consultant for the IMF. When you asked me, “Where do you think we are in the economy?” My perspective on topics like that, which I don’t have necessarily an expertise, I’m predicting those things. Those conversations mold my perspective on how to prepare for that. If you are interested in commercial real estate, it’s a fairly dense podcast. It’s a little bit more detail-oriented than those that are focused on beginners for example. If you listen to ten episodes, you’ll be where I was after a year of dedicating full-time to education.

What’s the name of the podcast?

Cash Flow Connections Real Estate Podcast. The name of the company is Cash Flow Connections and it’s about real estate.

I would love to have you again down the road a little bit as well to keep us abreast of some things. We get some things in too from different banks and asset managers so there’s a reason we were supposed to connect originally on some of these assets. It’s all about your network. It’s all about having relationships where you can pick up the phone and call somebody when you need help. I don’t think enough people ask for help earlier on in their pre-problem issues. If you reach out, oftentimes most problems can be solved with a phone call or discussion with a friend or a peer. What’s the best way for people to get ahold of you?

You can find the website at CashFlowConnections.com. If you enjoyed this conversation and you made it to the end, I’d be happy to shoot you a couple of eBooks. You can get those at Info@CashFlowConnections.com. Email me and I’ll shoot you a couple of eBooks.

Hunter, thank you so much for taking time out of your busy schedule to be on the show. We’ll be in touch.

I appreciate the opportunity.

Take advantage of those offers. It’s a great chance to get some eBooks out there as well adds to your library. Go out and take action. We’ll see you at the top.

Important Links

- http://www.CashflowConnections.com/

- Cash Flow Connections

- Hunter Thompson

- Grant Cardone – previous episode of Cash Flow Connections Real Estate Podcast

- Doug Casey – previous episode of Cash Flow Connections Real Estate Podcast

- consultant for the IMF – previous episode of Cash Flow Connections Real Estate Podcast

- Cash Flow Connections Real Estate Podcast

- Info@CashFlowConnections.com

About Hunter Thompson

Having a background in economics has allowed me to achieve a holistic approach to analyzing real estate data and has led me to a unique perspective on out-of-state investing. The goal of my business is to help clients invest in passive cash flow opportunities that provide a healthy return on investment, without the headaches associated with the stock market’s volatility. I have analyzed and closed residential real estate acquisitions, hard money loans, bridge financing opportunities, commercial and residential syndications, mobile home parks, retail opportunities, and syndicated office space investments. I have worked with multiple asset teams across several geographic locations in the US and Canada. My main priority is establishing an extremely diverse portfolio without exposing client’s capital to unnecessary risk.

Having a background in economics has allowed me to achieve a holistic approach to analyzing real estate data and has led me to a unique perspective on out-of-state investing. The goal of my business is to help clients invest in passive cash flow opportunities that provide a healthy return on investment, without the headaches associated with the stock market’s volatility. I have analyzed and closed residential real estate acquisitions, hard money loans, bridge financing opportunities, commercial and residential syndications, mobile home parks, retail opportunities, and syndicated office space investments. I have worked with multiple asset teams across several geographic locations in the US and Canada. My main priority is establishing an extremely diverse portfolio without exposing client’s capital to unnecessary risk.