As an investor, how can you protect yourself and your business? Arming yourself with some key strategies that can help your business thrive despite these chaotic economic times is key. In this episode, Scott Carson breaks down the ten steps every investor should be doing to help protect themselves and their real estate and note investment business. These steps can help you get through the next 60 to 90 days. He also explains the importance of calling vendors, borrowers, and other people related to your business.

—

Watch the episode here

Listen to the podcast here

Ten Things You Should Do As A Note Investor

I hope everyone’s doing well. It’s a bit of a different time. It’s changed across the country. As some of my friends and I have said and we live in a different world than we did before. Hopefully, whatever part of the country you call home, you’re taking the proper precautions. You’re healthy. Your family is healthy and safe. It’s a bit of an interesting time that we live in. First and foremost, our thoughts and prayers go out to everybody that’s stressed out, sick, our first responders, all our medical personnel, our military as well too. Our different leaders at the state national levels as well, obviously dealing with this pandemic, the Coronavirus.

What I wanted to do, as I was thinking about what to focus on for a variety of reasons, one, I wanted to make sure and offer an opportunity for you guys to come together in some sort of normality. That’s one of the biggest things a lot of people are struggling with. It’s okay. Our sense of normality has changed. Whether you’re voluntarily staying at home, like we are in Austin, or you are required to stay in San Francisco, LA, or other areas or you’re still like, “What is going on in other parts of the country?”

I’m trying to have some normality. I’m wanting to go through a couple of things though because I’m getting a lot of questions. There are a lot of things that are popping up and us, like real estate and note investors, there are some things that we should all be doing proactively to help ours, yours, other businesses, our borrowers and other things like that. I want to go through these things with you guys and gals. Some of these things you may do, other things you may not have to do. I want to cover some things after having quite a few conversations, not only on the phone with our friends across the country in different real estate markets, but also some of our vendors and our longtime friends in the note industry. Just saying, “Here are some of the things that we should all be doing that I think maybe we take for granted. Whereas we’re bombarded with all the news, ‘What should we do? What shouldn’t we do? What’s available out there?’”

We’re going to go through that with you as well. First and foremost, if this is your first time on Note Night in America, we have these roughly about every Monday night. You can always go to WeCloseNotes.tv to catch all the replays of Note Night in America. It will take you directly to our YouTube channel. Make sure that you subscribe when you’re there. Leave a comment. I’m always pretty sure about answering or responding. As we upload things, videos, podcast episodes, I know some people would rather watch videos versus listening. That’s why we try to hit multiple channels and different media so that you guys can gain and grasp the knowledge that we’re trying to provide.

Check out our other show as well, The Note Closers Show. As always, you can go to WeCloseNotes.com. We had an event, the Note Weekend. We do these one-day online note training basics. It’s a mini workshop or as some of our students have called it the cliff notes version of note investing. We live stream on Saturdays and restream on Sundays. We dropped the price to $19. It goes from 9:00 AM to 4:30 PM, 5:00 PM Central Standard Time. That cost is still good for a while.

We probably will have a three-day class. That $19 or if you’ve paid $99 for the February one, that is applied to the future workshop costs as well. We’ll use a coupon for that and then, of course, we’re going to have in August, September and October of 2020. I don’t know about June or July. If we are still in our houses or things aren’t back to normal, we’ll do it again in June and July as well for you. We’ve had some things planned. It’s probably going to be delayed to a later date but honestly, thank you for those that were part of it. Hopefully, it was valuable to you. We believe it was. Thanks to you, team Robert, everybody out there has been through that as well. Replays are included with that, so if you paid for that, you should have gotten replays.

You can buy the replays at $19 by going to NoteWeekend.com. We are helping our friend Linda Pliagas with the Realty411 Expo. It was scheduled to be a one-day event in Irvine, California. With the Governor of California banning any events over ten for the last quarter, public events, we knew this was not going to happen. We reached out to Linda and we’re helping her as she turns this into a two-day online event. We’re excited about this. The big whopping cost of this is zilch, zero, nada. It is no cost to attend. You can go to the Realty411Expo.com or you can sign up directly at Realty411VirtualExpo.com. That’ll take you directly to the webinar opt-in. You’ll be able to tune in and ask questions of all the speakers that are coming.

They’ve got a good lineup of speakers. I’m glad to be helping out. It’s our way to help out our friends at this time. She had 400 people RSVP. They’re probably a good 200 plus on the webinar on the Zoom call. I don’t want to take too much your time. I know you have family, or maybe you do want to be on here longer if you had to be around your family all day. I had somebody of you that are like, “I’m going to stir-crazy if I’m with my spouse for another two days, two months or two weeks.

The ten steps to take for your note business. As I was thinking about this, there have been things that we automatically roll into. Now, if you’re on Stay Calm and Invest, we’ve also talked about this in some of our podcast episodes. We had Jason Hartman on and recorded a great episode with him talking about pandemic investing and the things to come. We did a shorter episode on YouTube about the changes that are taking place. We’ve called some of the things that have happened and have rolled out that we’re not surprised. I’m by far not saying I’m Nostradamus of any sort. I’m just saying we’ve been through this before and been advised by people who’ve been through 2, 3, 4 different ups and downs in the economy. You have to expect some things taking place.

While I believe that we’re creating a twelve-month problem for a 60 to a 90-day hiccup with a lot of the different things, it still impacts us all on a variety of platforms and things that we’re doing. Not only for us but the economies around us, the people that we work with, the vendors. If you’ve got real estate, your borrowers, tenants, investors, and things like that. These are the ten steps that you should probably take for your note and real estate business to help you be prepared for the next few days. Hopefully, it’s just a couple weeks and not three months, but what they’re doing, and some of the delays. These are the things you first immediately want to do.

Reach Out To Borrowers

If you’ve got notes, performing or nonperforming, the first thing you want to do is have some reach out to your borrowers. You may do this through your servicing company or a specialty servicing company. You may want to do this because I guarantee you probably need to talk to your servicer as well if anything. We’ve already had borrowers starting to reach out to us, “I’m not paying.” “Do I have to pay?” “I am paying, what’s going on?” Talk to your borrowers. The sooner you can make contact with your borrowers, whether it’s performing or nonperforming, the better you know what’s waiting to be. Some of our borrowers are like, “I’m still working. I’m good. I can pay.” Others are like, “I’m a little tight with everything else. We’ve lost one income,” or things like that.

Here’s the biggest thing, reach out to your borrowers. You’re not going to be able to foreclose or evict them anyway, right now. It’s best to at least reach out and have some conversation. There are some things that you can do to be creative. One of the things that we have is the opportunity to say, “If you need to delay your payments for 60 days or 90 days,” I can’t expedite but one of the things that we are offering up if they’re asking for it and they were paying is like, “If you need to, we’ll give you 60 days. We’ll suspend the payments for 60 days, but if you do make a payment, we’ll give you credit for two. If you pay one month, we’ll give you credit for a second one. We’ll take that off the balance if you’re behind. For every $100, every bit extra of your payment, we’ll forgive double that.”

That’s one thing that’s going to incentivize your borrowers to keep paying if they can. Someone will be like, “I’m going to take it off because Trump’s going to not enforce foreclosure for 60 or 90 days.” It’s totally fine but I would rather have that conversation say, “We understand your type of situation. That’s okay. If we need to come back in 90 days to start paying again. There’s not much we can do.” I like to incentivize and give the opportunity like, “If you’re still working and you still have a job, make an extra payment, we’ll forgive you one.” That’s one thing that is important. Talk to your borrowers. Know what’s going on. If your servicer is not going to do that for you, you might want to go ahead and do that yourself. If you’re sitting at home and you’re bored out of your mind, this might be a good time to pick up the phone and call your borrowers.

Note Investment Business: Checking on your tenants or friends can be a great way to add value to you and your business.

You can always go back to your servicer and say, “Here’s what we’re doing.” You can always reach out to your servicer and say, “Let’s draft a letter. Let’s get a letter out to our borrowers. Here’s what we’re offering.” Be proactive and keep the lines of communication. Get updated contact information, “Where are you working? What’s going on? What’s your situation? We’re calling because we care.” That’s the biggest thing. You’re not going to be the person that evicts or forecloses and it’s time, but you do not want the bad publicity. That’s the same thing. Talk to the people around you. I’m seeing this on Facebook groups, people are like, “Am I going to get evicted? Am I going to get foreclosed out because I can’t pay?” No, that’s not going to happen. Although, I do highly encourage you to watch the Palm Beach County, the meaning of the city council. It went off the hook. One guy was like, “You’re turning off power two people this week?” A lot of the services and utilities are not going to turn things off. Pick up the phone, advise your borrowers to do the same, and to call their utility department and tell them what’s going on.

Call Your Bank

That’s number one. Call your borrowers, keep the lines of communication up, and get some right information from you. Two, call your bank to see what they’re offering. Call your mortgage company. If you’ve got lines of credit, commercial, or personal lines of credit, you may want to go ahead and pull some money out. Because in these times, banks are notorious for shrinking down lines of credit because they can. It doesn’t mean you can’t go ahead and pay it back, but I would say if you’ve got a line of credit, you may want to pull some money off of it and put that money aside. Just in case, God forbid, that we have a total meltdown on everything.

I don’t think we’re going to have that, but it’s better to be safe instead of sorry especially if you have family members or other people that rely on you. It may be expensive, but if you’ve got a line of credit or credit card you may want to pull some money off it and then put it back in 60 or 90 days. Prepare yourself, call your bank, see what they’re doing and see what their plans are. Maybe you can get away without having to pay a mortgage payment for a month or two, and use that to be proactive and then pay it back later on. A lot of the banks are doing things. Forgiving payments or not looking to collect for the next 60 to 90 days to help everything else. Call your bank. Call your card and see what’s going on with that. Call if you’ve got student loans, car payments, and call a variety of the lenders or the borrowers that you’re in.

Talk To Your Tenants

Number three, talk to your tenants. If you’ve got a rental property or Airbnb, pick up the phone, talk to them and see what they’re going through. See exactly what they’re going through, “Are you working?” “Are you not working?” “Where are you working at?” You’re not going to be evicting and eviction changes on a state by state basis as we all know, but still talk to them and say, “I’m just calling out of concern. How’s everything going on? Are you doing okay? How’s the family? Are you working?” Try and find that stuff out because there’s a lot of uneasiness and the more that we can communicate, the more we can talk, the more we can still come together of some sort. Maybe it’s not in person, but at least on the phone or Zoom call or something, a Facebook Live, or whatever it might be. Talk to your tenants.

I know that from talking with some friends, they’ve had Airbnbs that have been canceled. They’ve had tenants that were in the process of moving which is not a good thing if you’re in a lockdown area because you’ve got a lot of moving parts. The more you can talk to your tenants about what’s going on like, “Are you working? Do I need to forgive rent for a month or two?” That’d get through things. Not everybody is prepared. Who knows when the stimulus package is going to go through based on the news that I’ve read? The two sides can’t decide on things and let’s all face it, whether it’s $600 or $1,600, once or twice, it’s still not enough. For some people, something is a whole lot better than nothing. Maybe you can figure out something with your tenants to help out in a variety of ways. Get some credits for some work or other things. Make sure you talk to your tenants, whether it’s a long-term rental or short-term rental. Get on the phone and talk about, “How’s it going?” Trust me, they will love you for that.

Call The Employers Of Your Borrowers

We found something out too. We were looking at a property and it’s rented somehow. Somehow a property is rented with people living in it that we didn’t collect rent on. Be careful because there are illegal people out there too. We’re going to have a little come to Jesus meeting with a property manager that we found has been renting the property and didn’t pay us. Talk to your tenants to find out what’s going on. Make sure you have people looking by your assets as well too for you. Number four is important. Call the employers of your borrowers and your tenant. If you can’t get ahold of them, you should know based on your mortgages, that loan documents, or if you’ve got tenants. A long-term tenant will tell you who their employer is. Pick up the phone and see what’s going on. See if you can get the real story in case you’re not.

Some industries are booming and your trucking industry is doing well. There are employers looking for jobs, like the different grocery stores, Amazon, shippings and Walmart. A lot of these larger employers are looking for work. If you’ve got a tenant or friend who’s out of a job, and there’s something nearby, it’s worth saying, “Go and check this out.” That can be a great way to add value, not only to your friends, your family members, but also your tenants or your borrowers. See what’s going on there. See if there’s a Walmart or Amazon nearby or whatever’s going on.

We’ve all heard stories of grocery stores that are running short. People aren’t showing up to work or even when trucks show up. They’re being almost looted before they’re even empty, so take the opportunity, be a little proactive, and call around. See if your borrower is out of work or has had reduced hours and things like that. You can do a VOE, a Verification of Employment. We all know the unemployment rates going to go up. It already is. It’s going to take a while for it to recover so if you’ve got employees that are in the travel and tourism, those two big industries and stuff like that, do yourself a favor. I had somebody in the podcast that’s like, “This is something that 3 or 4 of my friends could do from home,” especially this time of year and go from there.

Scaling Back On Rehab Costs

Number five is, if you’ve got a rehab going on a property, you probably want to scale back on the costs. You want to scale back on whatever you’re putting in. Maybe you’re not putting on top of the line and you’re taking it down a notch. Whatever you can do to get that property to market sooner than later, it’s going to be valuable to it. I’ve talked to friends, “We’re rehabbing a property to put as an Airbnb.” We’re scrapping that back and put it to a rental or to sell it.

If you look at MLS across the country, the number of price reductions have skyrocketed across the board. We know that here in Austin, Dallas, San Antonio, and Houston, from some of the emails that I sent out to people, “Can you run a quick search for me on your MLS on how the price reductions have happened?” It’s drastic. If you were in that area and you don’t have a property listed yet because you’re working through it, drop it down, do whatever you need to do to get done. You never know when it’s going to be a lockdown. If that ends up happening. I’m not trying to spread fear at all. I’m just trying to be prepared. It’s not the time to rehab it exactly as you would like it to live in. You shouldn’t be doing it, to begin with. Look at the timeframes and what you can do to cut costs, but also get things done in a timely fashion.

Reduce Bills

Number six is to reduce your bills as best you can. Look at what you’ve got going up on a weekly or monthly basis. Maybe it’s time to change your debit card in the first 30 or 60 days so things don’t get auto-charged. You never know. I hope it’s not that way. I hope that we’re all back to normal, that would be the ideal thing. Look at your expenses. Anything you can cut cost on or scale on for a little bit, do so. I know we’re saving money. We’re not going to the movies 2 or 3 nights a week. We’re here, which is fine. I’m cooking. I love to cook easily every other night. Cooking one night and eat leftovers on next night. Reduce your bills in any way you can. Try to avoid things that you don’t need. It’s one of the best things I can tell you. Maybe shutting down some of your online tools and some things you don’t regularly use so you can get away without having to use it on a pretty regular basis for you.

There are some services that I love and I am absolutely a huge fan of, but I’ve gone in and reduced them. I don’t need the maximum level, I’m going to drop it down to the base level. I’ll give you a great example. When we do videos on a regular time, instead of going one at a time on Fiverr and paying $10 plus a $2 to $3 service charge, I send four at a time. It’s still $10 per video, but I’m not getting charged a service charge every time. It’s only one service charge which saves me an extra $3 per video. That adds up.

You may look at what you’ve got going. We’ve all got things that go out of our accounts on a monthly basis. Pull it up, take some time, “I need to cancel this, I haven’t used this in a while. I need to reduce this. I need to suspend this for a little while.” That’s the thing, reduce your bills. If you’ve got student loans or other things, pick up the phone. Give them a phone call and say, “My income’s been reduced. Can I suspend my student loans for six months?” Unless they won’t allow you to do that. Reduce your bills in any way that you possibly can and it’s important to do that.

Note Investment Business: With money being very cheap, a lot of the funds can borrow money really cheaply.

Call Your Vendors

Number seven, call your vendors not just to see what’s going on but the people maybe you haven’t talked to in a while. I have had some great conversations with people I haven’t talked to in a while. I just say, “How’s it going in here and how is business doing? Where do you see business popping in later? How are we going to make money in this timeframe? What are some things that you can do?” It’s my whole reason I reached out to Realty411 like they’re not going to have an event. I want to try and help them and they’re helping me in some cases as well too for a variety of things. Reaching out to some of my sellers who haven’t had anything available for sale for a while, talking about where we think the market is going to be.

You’re not going to be buying defaulted notes tomorrow with everything going on. The first sign we’re going to see anything is probably 90 days to 6 months because a lot of the lenders are going to wait to see what the banks do and the government does the bailout. You’re going to have the borrowers either take action or they can’t take action. With money being cheap, a lot of the funds can borrow money cheaply. They’ve got money at 0% and they’ve got a 1% interest rate and you’ve got a 3%, 4% mortgage on a note that you own, modified, or have. They may be willing to buy it now because if it’s performing, that’s a 400% return on investment form with the arbitrage. It’s not 3%, but 300% to 400% return to them, so talk to your vendors.

There may be some ways for you to barter services like, “Do you need some help? Are you running on a skeleton staff? Maybe I can help out. I’ve got some time. I’ve got a couple of hours each day now that I’m working from home. How can I best help you out?” That’s how you keep your ear to the grindstone. It’s how you hear what’s going on in the markets. How people see these great opportunities come to light down the road because you’re staying involved and you’re touching base. Let’s face it, sometimes it’s nice to pick up the phone and talk to people. I know some people go stir-crazy, but those that live alone, that’s going to be the toughest thing. Not having that personal contact of being able to talk to somebody face to face or having coffee, or getting out of the house. Sometimes we’ve got to get out of the house. Call your vendors. Go for a walk, put your headphones on, and talk to a few people while you take a stroll.

Look At Your Price Reduction And Start Protesting Taxes

Number eight and this is something that’s going to be coming up here. Everybody on every property you have, look to start protesting your property taxes. I don’t care where you’re located at. You’ve got to learn to protest these things. They’re not going to come out until May 15th, 2020 with this but start expecting to protest your taxes. Property values are going to be dropping in places. Keep that in mind. Get on your calendar and circle May 15, or the month of that, “I need to protest my taxes.” It’s going to take a little while and may not be able to because they may extend it out for a while, but this is one thing you do to save money across the board on any properties you’ve taken back.

Sometimes it’s easy to get done, other times, it’s not so easy to get done. If your vendors aren’t working, if they are not doing work for you, they’re on a skeleton crew for a month or two, it’s important that you’re not getting charged for services that they’re not providing. Think about this, if there are attorneys in counties, closings, or things you have going on, and they’ve shut down, you’re not going to have foreclosures for 60 days, so don’t be paying attorney fees between those times. It’s important to look at statements, and look at your vendors to see what’s going on, “Did I get this kind of service during the month? No, I did not, then I need to credit.” That’s something that adds up.

Limit News Intake

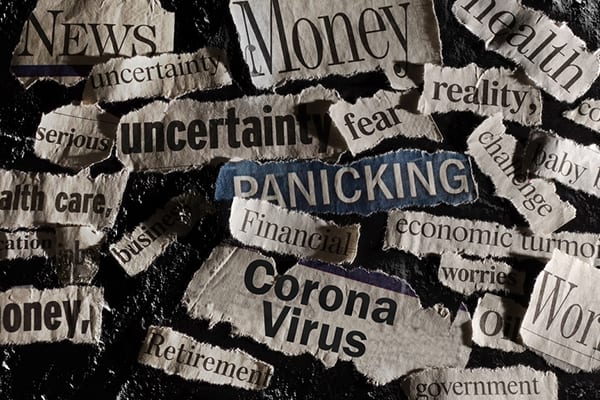

Number nine, this is going to be hard for some of you. Limit the news intake. I know we live in a digital world where you’ve been bombarded on our cell phone, on pop-ups on our computer, on our laptops. I wouldn’t be surprised if it starts happening and mirrors and things popping up here like the Minority Report. Limit your news intake. Step away from it. I know a lot of people are looking like, “I’m going to watch a bit more Netflix or Amazon this time.” That’s great. You sometimes don’t know what’s going on and this is the thing that frustrates me the most. This is the thing that irritates me over and over again. How the media slants things that make it sound a whole lot worse than it is. I’m not saying, “Don’t quarantine yourself.” I’m not saying, “We’re facing things,” but let’s face it if we keep bombarded with negativity, that negativity comes out. It depresses us, especially if it’s gray and nasty.

Limit your news intake. I don’t look at USA Today in the news, except for a few minutes in the morning, and then a few minutes in the evening. I don’t look at the news at all. I’m not even on ESPN most of the time, which I usually have up. Limit your news intake and you’ll feel better and happier, “I’m going to get a highlight here, and a highlight there.” Trust me on this. This is one of the most important things that you can do is limit your news intake because you don’t know what’s truthful. A lot of times, you’ve got to get news from both two different spots to figure out where the truth lies in the middle. Limit it from your trusted sources, not the extreme out there.

Laugh Daily

Number ten may surprise you. It’s laugh daily. Find something to laugh about because God bless us all, we’re going to look back at this in the future and laugh like, “You remember when we made through the Coronavirus?” “I had a little sickness.” “I had a little tickle in my throat.” Do you get what I’m saying here? Find some way to laugh each day. One of my favorite things to do is, I’ll pull up Key & Peele from Comedy Central. Put my headphones on and watch an episode or two while I’m working on my laptop, or pull up YouTube on the TV or in Saturday Night Live reruns. Try to laugh daily, go for a walk, and realize it’s all going to be okay. It’s easy to get bought into the doom and gloom and all this other stuff but people are overreacting cleaning out the shelves.

We went to the grocery store and walked around. It was a little disturbing seeing a lot of shelves clean but when you look back, you look at all the fruit, all the vegetables and other things that are coming in, shipments are still coming. Some people are hoarding and it can be depressing, but if you think about it, if you’ve ever traveled abroad, we still have more wealth, more food and more opportunities. The ability to still take out and to get a cup of coffee at Starbucks. If you need to get Chick-fil-A and drive-thru, you still can. Laugh daily. Try to laugh at this. Try to find something humorous because it will do your soul some good.

We’re all in this together. Laugh daily, find something to laugh at, as Jim Valvano used to say, the legendary coach from NC State, “If I can be moved to tears in a day and then also move to laugh in a day. It’s been a good day.” If you can laugh and cry in the same day, it’s a good day. Let’s try to avoid the tears, the depression, let’s try to laugh daily. Poke fun at what’s going on. That’s the only way we’re going to get through this without it being a bigger cluster F if you know what I’m talking about.

I was enjoying the XFL. We need the Renegades and the Wranglers here in Texas. I know a lot of people are saying this March Madness is down or it’s gone. Things are still operating. We’re in a little bit more of a chaotic environment but just laugh. That’s all that we can do and I encourage you to do that. If you need to bitch, moan, or vent, remember one thing, crap should flow uphill not downhill. If you’ve got family members, and you’re frustrated or scared, don’t make it worse by venting down. Vent up. Pick up the phone, go for a walk. I’m glad to jump on a phone call and talk with you as best I can.

Everybody’s going through troubled times. I’ve got some deals that are dragging out even longer. I can’t get a title company call me back on closing. I’ve got other assets that are dragging on. I just laugh, it’s all I can do. Now we’ve got plenty of food. We’re safe here in Austin. I can still go around and do things unlike some others, but I’m not going around. I’m working from home, trying to laugh and have as much fun as I possibly can. Enjoy cooking every other night and laughing. I spend time with our animals and then doing some stuff in marketing.

We’ve got plenty of time to enact things. Reaching out to asset managers is a good thing, but it’s worthless to do right now. If you’re going to be building any type of online stuff, put your marketing in place so that you’ve got something available when 60 days rolls around, or six months whenever they finally get around the ring thing. Talk to your investors, start pulling lists of asset managers or IRA investors. What else are you going to do? You can still order direct mail through Vistaprint and PostcardMania. FedEx is still open. They can put orders in and pick up. Laugh daily, have fun and live life.

Note Investment Business: Being bombarded with negativity from the news can keep us depressed.

That’s all that I’ve got for you. These are the ten steps. Let’s recap. Once again, one, call your borrower to see what’s going on. If they need some time, you’re not going to be able to foreclose or evict anyway. Offer them some incentives and get creative, “For every month you pay, we’ll forgive a month,” or “If you can at least bring half a month, that would be helpful for things in the long run.” The second thing, call your banks if you’ve got lines of credit that have gaps in it, as far as you’ve got availability, you may want to pull some of that off for the heck of it. You can always put it back. You may want to call your bank to see what the situation is with your mortgage, car payment, or your student loans. Call and find out and maybe use some of these things that are available to you as well to help smooth things over for you. You never know what’s going on.

Three is talk to your tenants. If you’ve got short-term or long-term tenants or renters in place, talk to them and see what’s going on. How are they affected? It’s the same thing. You’re not going to be able to evict anybody. Nobody’s going to enforce an eviction. Work with them, find out maybe there’s a way they can do some stuff for you. Maybe they can do some other things to offset that rent. It’s an important thing. Maybe it’s time to barter a little bit. Four, call the employers. If you’ve got your rental applications and your loan docs, you can see who the employers are for your borrowers and your tenants. Pick up the phone and give them a phone call. If they are laid off or not reducing, maybe reach out and say, “There’s the opportunity to work at grocery stores, Amazon, delivery drivers, or do some at home bookkeeping.” In two weeks, you can be certified on QuickBooks and start doing books for people out there relatively cheap. Check that out. Be an asset to your tenants or your friends or your families out there as well.

Number five is to reduce rehabs. If you’ve got rehabs going, reduce your costs, try to get them back on the market ASAP, and maybe reduce the number of rehabs. Instead of going from A+, maybe just go into A. That high-grade property may be going with FHA, the four-pound plan. Six is to reduce your bills. Look at what you’ve got going out monthly and reduce it. Maybe you have to cancel a debit card, that stuff has been auto-drafted on for a little while. It’s not going to hurt anything, but keep it going. If this does drag a little bit longer, you’d be glad that you saved now versus trying to save later on.

Seven, call vendors. See if they’re working, “Are you working during this time? Are you on a skeleton crew? What’s going on in the market? What do you hear and what do you expect?” It’s good to have a conversation. It’s also good to make sure that you’re not getting charged with something that’s not happening. Eight is something in the future but start looking at the market that you’re in and start protesting taxes. There are a lot of price reductions on the market that are going to affect property values, especially as we get around to May 15th, 2020 when most people can protest taxes. Keep that in mind.

Number nine, limit the amount of news intake. A little bit in the morning, a little bit in the evening. Don’t be bombarded by it nonstop. Avoid sitting there and reading nonstop fake news or sensational news, which we all know is not accurate. Ten, laugh daily. Find something you can laugh at. Whether it’s old reruns or your favorite comedy. Poke fun at things. Have a game, turn the TV off, play cards, whatever you might need to do. Laugh, snuggle, and realize we’re all in this together.

That’s all that I’ve got for you. Feel free to reach out. We’re glad to help out in any way we can or help to be a vent for you. I also encourage everyone to take some time and improve yourself. Learn something and improve something. Jump on LinkedIn Learning and Lynda.com. There’s so much stuff out there. Go for a walk, do some pushups, learn some new skills if you’ve got the time at home. Hone your skills, if you’ve got something you want to work on. You can learn a lot on YouTube for free including the 900 and some odd videos we have available. Go out and take some action. Make some phone calls. I hope this was helpful. You may forget some things but nobody’s going to protect your money as you would. Go out and take some action. We’ll see you all at the top.

Important Links

- WeCloseNotes.tv – YouTube channel

- NoteWeekend.com

- Realty411Expo.com

- Realty411VirtualExpo.com

- Jason Hartman – Facebook Live

- YouTube – Jason Hartman episode

- Fiverr

- QuickBooks

- LinkedIn Learning

- Lynda.com

- http://www.NoteBlueprint.com

Love the show? Subscribe, rate, review, and share!